Saba Software to acquire Halogen Software (TSX:HGN)

Sunil Grover, Managing Partner

sgrover@truebluepartners.com

(669) 900-4031

Deal Financials

Purchase price/share: CAD$12.50

1/23/17 price/share: CAD$10.00

Implied premium: 25%

Implied EV: CAD$230m

EV/LTM Revenue: 2.5x

EV/LTM EBITDA: 53.3x

Transaction Overview

- February 23, 2017 Halogen Software announced that it has entered into a definitive agreement to be acquired by Saba Software

- Saba and Vector Capital will acquire all the issued and outstanding shares of Halogen for CAD$12.50/share, a 25% premium to its unaffected share price 30-days prior

- Pervez Qureshi, Saba’s current CEO, will remain as CEO of the combined platform and Halogen Executive Chairman Michael Slaunwhite will reinvest existing shares into, and become the Chairman

- Halogen Software provides mid-market cloud-based talent and performance management solutions

- Saba Software provides similar products and hopes the acquisition will help boost its SaaS offering and re-position it as a leader of end-to-end talent management solutions

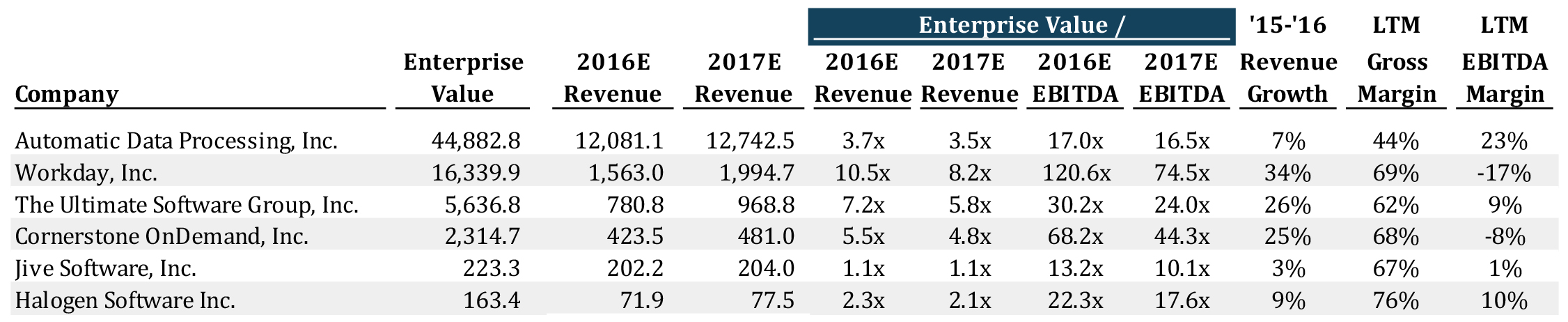

Talent and Employee Management Software Comparables

Values in millions of USD

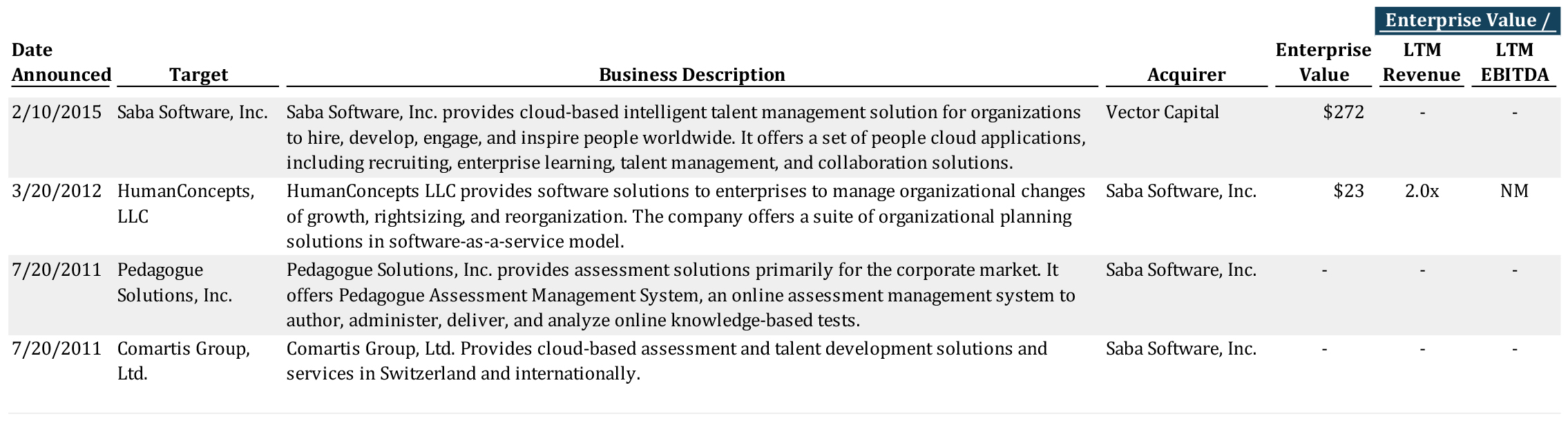

Saba Software’s Turnaround through Privatization

- Saba had made several acquisitions between 2009-2012 in hopes of developing its cloud offering

- In 2015, Saba made a distressed sale to Vector Capital after it was delisted from the Nasdaq following an accounting fraud scandal and SEC-negotiated clawbacks of millions of dollars from executives within the company

- One year later, Vector is now helping Saba acquire Halogen, which will nearly double the size of the business, and add a strong cloud presence

Vector Capital’s Expertise in Software Turnarounds

- Vector Capital specializes in turning around distressed businesses, a similar case being Corel Corp.

- 2003 – Corel Corp., the creators of WordPerfect, is delisted from the Nasdaq and Toronto Stock Exchange after the dot-com crash and privatized by Vector Capital

- 2006– Vector helps Corel acquire WinZip, and on the same day completes its second IPO at $16/share

- 2008– Corel faces headwinds from the financial crisis, and begins seeking financial buyers to recapitalize; Vector’s offer of $11/share is rejected

- 2009– By Q1 2009, Corel’s stock price is below $2.50/share; deals with other parties fall though, and they eventually accept Vector’s updated bid of $4.00/share

- Current– Vector is amid restructuring the business, which has returned more than $300m in dividends

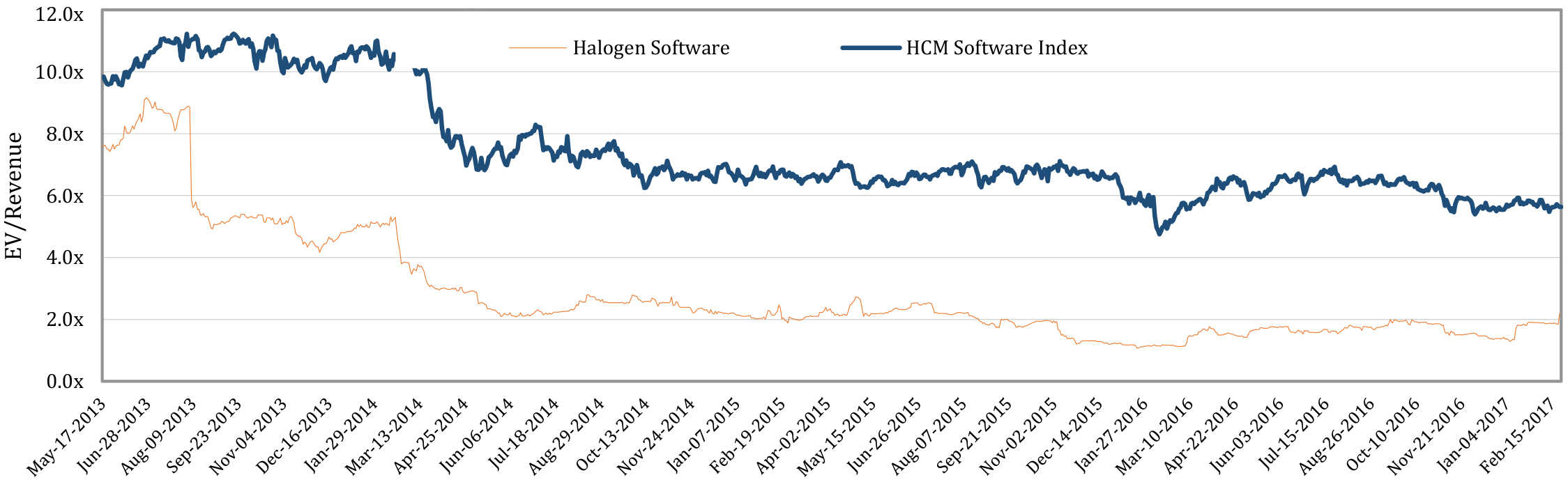

HCM Software Valuations Dropping, Market Consolidating

- Workday has the large enterprise HCM market dominated, and mid-market providers are beginning to consolidate

- Halogen is a stable business with 76% gross margins, and 10% EBITDA margins, but the YoY growth has been slowed down to around 10%

- Valuations for companies with growth rates less than 25%, despite having stable cashflows, are being left behind by investors as the segment consolidates, and are becoming prime targets for acquisition

* True Blue Partners founders were the advisors on the Infinisource transaction

Valuations in the HCM Software Segment

HCM Software Index includes: JIVE, CSOD, ULTI, SKIL, HGN

True Blue Partners is a M&A advisory firm that serves lower mid-market enterprise software companies, and provides its clients with over 20 years and of investment banking and technology business operations experience. It’s founders have extensive experience on all sides of a deal as a financial advisor, private investor, and founder operator, which allows for a unique perspective into the challenges and needs that companies face within the lower mid-market.