BC Partners Acquires Presidio, Inc.

Transaction Overview

- On August 14, 2019, North American IT solutions provider Presidio, Inc. announced that it has entered into a definitive agreement to be acquired by BC Partners for $2.1 billion, including Presidio’s net debt.

- Based on the terms of the transaction, Presidio’s shareholders will receive $16 per share, representing a premium of 21.3% above the closing price of $13.19 on August 13, 2019.

- Details of the transaction include a 40-day “go shop” period allowing Presidio to seek competing offers prior to closing.

- BC Partners has agreed to contribute $800 million of investor equity, and secured debt financing of up to an aggregate amount of $1.8 billion. Apollo owns 42% of the outstanding common stock and has agreed to vote in favor of the transaction.

Presidio’s LBO History

- Presidio has an extensive history with financial sponsors, having gone through multiple buyouts and exchanges of ownership between different firms.

- American Securities acquired Presidio for an undisclosed sum in March 2011. Presidio attempted a $1.5 billion IPO in May 2014, which was cancelled immediately prior to a $1.5 billion buyout from Apollo Global Management.

- Presidio’s valuation dipped to $1.2 billion in the 2017 IPO in an attempt to raise money to pay down debt. Apollo still maintained 42.5% ownership after a series of public offerings until its final exit in the sale to BC Partners.

- As a result of the multiple LBO’s and relatively high debt levels, Presidio has slowed its hiring and spent the majority of its resources paying down debt and acquiring companies in order to fuel returns.

- Many of Presidio’s acquisitions were aimed to increase its expertise in managed services, which directly correlates with higher recurring revenue and valuations. In its Q3 2019 earnings report, Presidio revealed that growth in managed services yielded a 52.4% YoY growth in recurring revenue, which now represents 8.5% of the company’s total revenue.

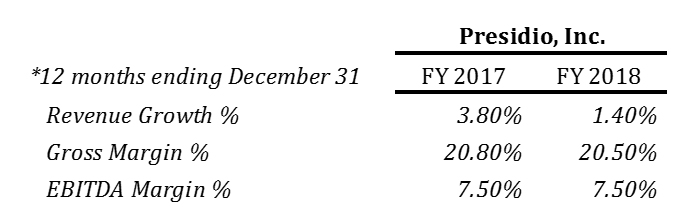

- While growing annual recurring revenue is a proven method of increasing valuations, Presidio’s low multiples upon BC Partners’ LBO stems from its relatively low gross margins of 20.6% and 20.1% for its product and services revenues respectively.

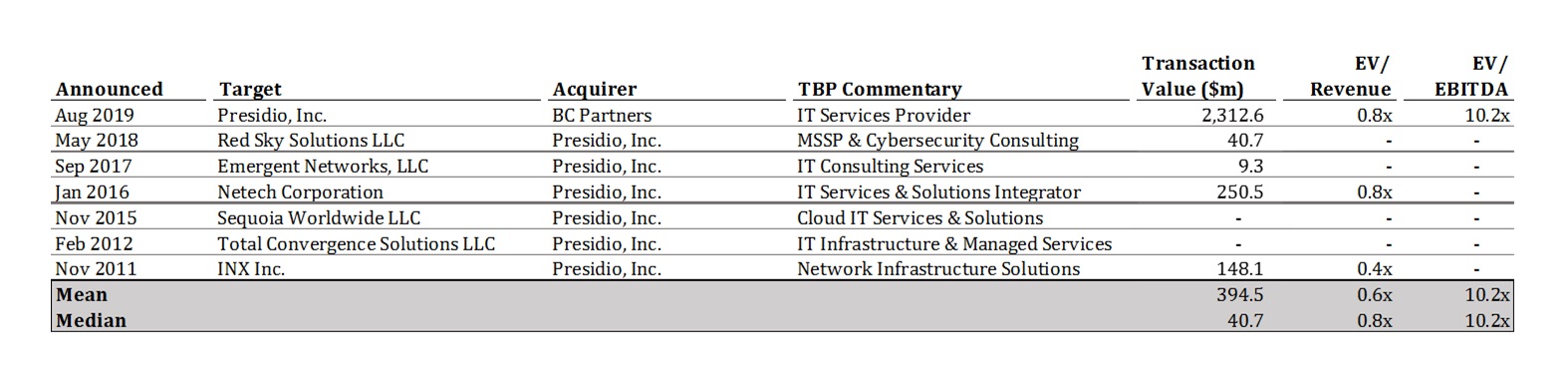

Presidio Transaction History

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.