Infosys Acquires Fluido

Deal Financials

| Total Transaction Value: | $75.6m |

| Revenue (2017): | $21.2m |

| Revenue Growth (2017): | 52.3% |

| TV/ Rev (2017): | 3.5x |

Transaction Overview

- On September 14, 2018, Infosys Limited (NSEI:INFY) announced its acquisition of FLUIDO LTD., an independent Salesforce Platinum Consulting Partner in Finland, for $75.6 million.

- Fluido is a regionally focused Salesforce consulting, implementation, and training partner based in Finland with a strong customer and delivery footprint in the Nordic region. It employs over 200 experts serving over 300 customers. It was incorporated in 2010, raised growth equity capital from Norvestia followed by CapMan with co-investment from Salesforce ventures

A Re-Focused Infosys

- This is Infosys’ second acquisition this year. Earlier this year, Infosys acquired WongDoody, an advertising agency.

- Salil S. Parekh took over the role of Infosys CEO in January 2018 from interim CEO U.B. Pravin Rao, who replaced former CEO Vishal Sikka.

- Simultaneously, Infosys has placed the companies acquired under Vishal Sikka’s leadership, Panaya, Kallidus and Skava for sale.

- This acquisition demonstrates Infosys commitment to the Salesforce ecosystem and is reflective of the highly acquisitive Salesforce Implementation partner ecosystem as outlined in TBP report on Investments and M&A trends in Salesforce Ecosystems

Story Behind FLUIDO’s Successful Exit

- Fluido incorporated in 2010 and hit the $5 million revenue mark in 2015.

- In the beginning of 2016, Fluido raised $3.6 million in its equity round, led by private equity firm Norvestia Industries Oy (subsequently acquired by CapMan) and Salesforce Ventures.

- In March 2018, Fluido acquired the Salesforce consulting business of Salesforce Nordic AB.

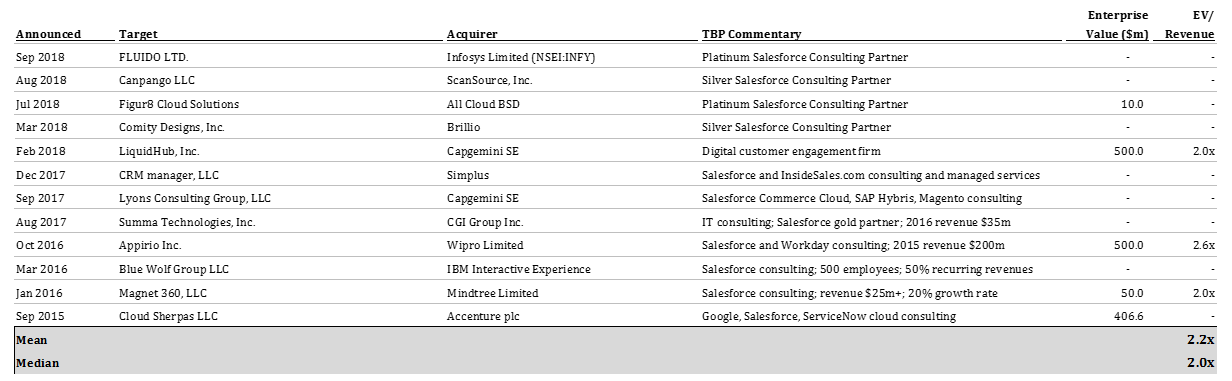

Select Transactions in the Salesforce Implementation Partner Ecosystem

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.