LinkedIn Acquires Drawbridge

Deal Financials

Implied Enterprise Value ($m): ~300.0

Transaction Overview

- On May 28, 2019, employment-oriented social network LinkedIn acquired Drawbridge, a provider of marketing solutions and analytics using machine learning and artificial intelligence.

- Notably, Sequoia Capital was an initial investor in both LinkedIn and Drawbridge’s Series A rounds. Sequoia invested in four of Drawbridge’s five venture capital financing rounds, and Kleiner Perkins invested in all five.

LinkedIn seeks to improve marketing analytics, AI capabilities

- Drawbridge’s core offering is its identity graph, which uses AI to leverage customer device touchpoints to build detailed profiles on how they respond to ads. Drawbridge boasts the ability to predict matches with 97.3% accuracy.

- The acquisition of Drawbridge will expand the reach of LinkedIn’s marketing solutions platform, as well as its capabilities for cross-device attribution. Cross-device attribution is the process of tracing customer touch points across different devices to lead conversion.

- In March 2019, LinkedIn introduced Lookalike Audiences, which combines business’ ideal customer traits with LinkedIn’s member and company data, allowing merchants to discover new professional audiences on a larger scale.

- LinkedIn seeks to use the identity graph to strengthen its Lookalike Audiences and Attribution features. The company hopes Drawbridge’s capabilities will help customers better measure marketing campaign ROI across both mobile and desktop devices.

- The deal comes less than a month after Salesforce bought Bonobo AI, which develops AI-based software that analyzes customer conversations, indicating how much AI is moving the needle in the CRM space.

LinkedIn has grown marketing platform significantly since acquisition by Microsoft

- LinkedIn Marketing Solutions revenue grew at 46% annually in the past year, compared to 27% growth for the company as a whole for Q1 2019.

- Drawbridge marks LinkedIn’s third CRM-related acquisition since it was bought. In 2017, LinkedIn bought Heighten Software, which specializes in sales process tracking and pipeline reporting, and PointDrive LLC, a provider of marketing content management, personalization and tracking tools, now integrated into LinkedIn’s Sales Navigator.

- Microsoft’s strategy of venturing further into the CRM space was a motivator in the decision to buy LinkedIn, as Salesforce was the losing bidder. With the addition of Drawbridge, Microsoft is taking another step to ramp up competition with Salesforce.

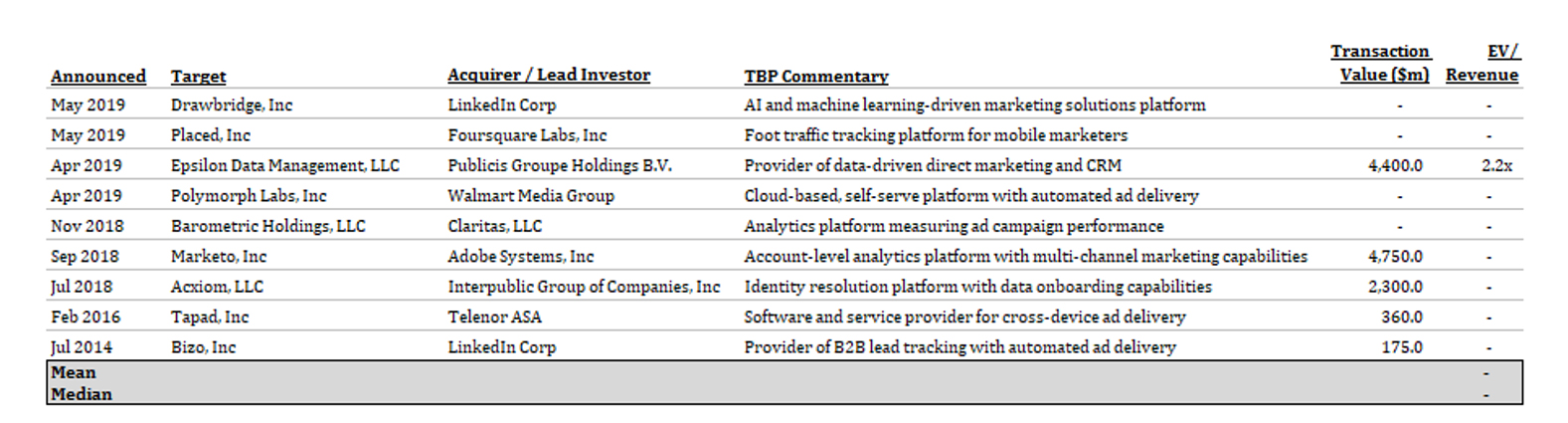

Marketing companies are growing their analytics and targeting capabilities inorganically

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.