Oracle Corp. (NYSE:ORCL)

Acquires API Management Company, Apiary Inc.

Sunil Grover, Managing Partner

(669) 900-4031

Transaction overview

- On January 19, 2017 Oracle announced plans to acquire Apiary, an API development and governance solutions provider, for an undisclosed amount

- Apiary was founded in 2011 and raised a total of $8.6M in equity funding to date. Its last round of funding, led by existing investor Flybridge Capital Partners, raised $6.8M in Series A funding

Oracle acquires to strengthen Platform as a Service (PaaS) offerings

- Larry Ellison believes Oracle is in running to be the first company to generate $10B in cloud revenue. It has been aggressively acquiring SaaS applications and cloud technologies.

- It has acquired 11 SaaS applications since 2014 investing over $15B and has recently been acquiring cloud infrastructure technologies to bolster its PaaS offerings to better compete with Salesforce’s Force.com, Microsoft’s Azure, Amazon’s AWS and Google Cloud.1

- Apiary was closely knit into Oracle’s PaaS as being the go-to designer portal for Oracle’s API Platform Cloud Service; the acquisition will create a unified API development and management platform

- API and integration development/management tools are vital for large cloud providers trying to maintain a flexible and open ecosystem for both application developers and end-users

- RedHat acquired 3scale in June 2015

- Google acquired Apigee for $625M in September 2015

- Mulesoft is apparently preparing for an IPO

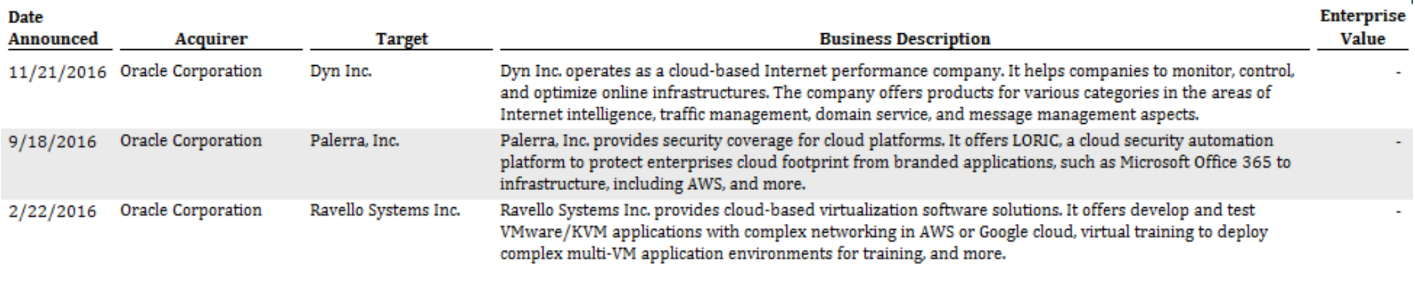

Oracle cloud technology acquisitions in 2016

So what does this mean for mid-market enterprise software and service businesses?

- Large enterprise clients are adopting a cloud first approach. Mid-Market software entrepreneurs with an on-premise license and maintenance model need to reposition themselves. Beyond being SaaS-enabled, this means re-engineering for a different cash flow model, sales team compensation, and sales channel incentives

- For system integrators and IT services organizations, this can mean opportunities to develop managed services offerings that extend the client relationship beyond the one-time implementation and upgrade engagements. It also means understanding and measuring the lifetime value of a new engagement rather that the one-time project fees

- These shifts are not easy and not without significant costs and risks. It warrants a close evaluation of whether these transformations are undertaken on a standalone basis or in partnership with an organization with greater resources

True Blue Partners is a M&A advisory firm that serves lower mid-market enterprise software and services companies. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

1 To request a more detailed review of M&A trends in the Oracle eco-system, please send a request to info @ truebluepartners . com