Salesforce Acquires MapAnything

Deal Financials

Total Consideration to Shareholders ($m): 225.0

Implied Equity Value ($m): 261.6

Transaction Overview

- On April 17, 2019, Salesforce.com announced its acquisition of MapAnything, the leader of Location-of-Things (LoT) solutions, to enhance its Sales and Service Clouds with a market-leading, geo-analytical, intelligence platform. Salesforce owned 14% of MapAnything prior to acquiring the remaining 86% for $225 million. The deal officially closed on May 31, 2019.

- MapAnything previously raised over $82.9 million of equity capital in three rounds of equity financing from notable investors including Salesforce Ventures, ServiceNow Ventures and GM Ventures.

- On November 16, 2018, during a series C funding round lead by GM Ventures, the company’s pre-money valuation stood at $220 million prior to receiving $42.5 million, representing a post valuation of $262.5 million.

MapAnything Overview

- Founded in 2009 by CEO John Stewart, MapAnything is based in Charlotte, North Carolina with roughly 150 employees.

- The company’s MapAnything Platform leverages mapping and optimization technologies to integrate map-based visualization, route optimization and asset tracking to improve the efficiency and productivity of field sales and service teams across numerous enterprises.

- MapAnything has a large customer base totaling over 1,900 companies in industries such as financial services, healthcare, technology, retail, manufacturing, nonprofits and the public sector.

Salesforce’s Appetite for Native & Complimentary Cloud Applications

- Over the last several years, Salesforce has demonstrated a pattern of acquiring applications natively built on the Salesforce Platform with prior investments from Salesforce Ventures to enhance the capabilities of its various clouds.

- Along with being a Salesforce SI Partner and ISV Premier Partner, MapAnything is a native Salesforce application that received equity investments from Salesforce Ventures in all three rounds of financing.

- Similarly, on March 12, 2018, Salesforce announced its acquisition of CloudCraze, a provider of B2B enterprise commerce solutions built natively on the Salesforce Platform. Salesforce ventures invested in CloudCraze back in 2016 for its series A funding round.

- In December 2015, Salesforce announced its acquisition of another Salesforce Ventures portfolio company, SteelBrick, for $360 million. SteelBrick expanded the Sales Cloud with natively built CPQ and QTC solutions.

- Read more about Salesforce’s ecosystem-focused strategy in our recent report, Investments and M&A Trends in the Salesforce Ecosystem.

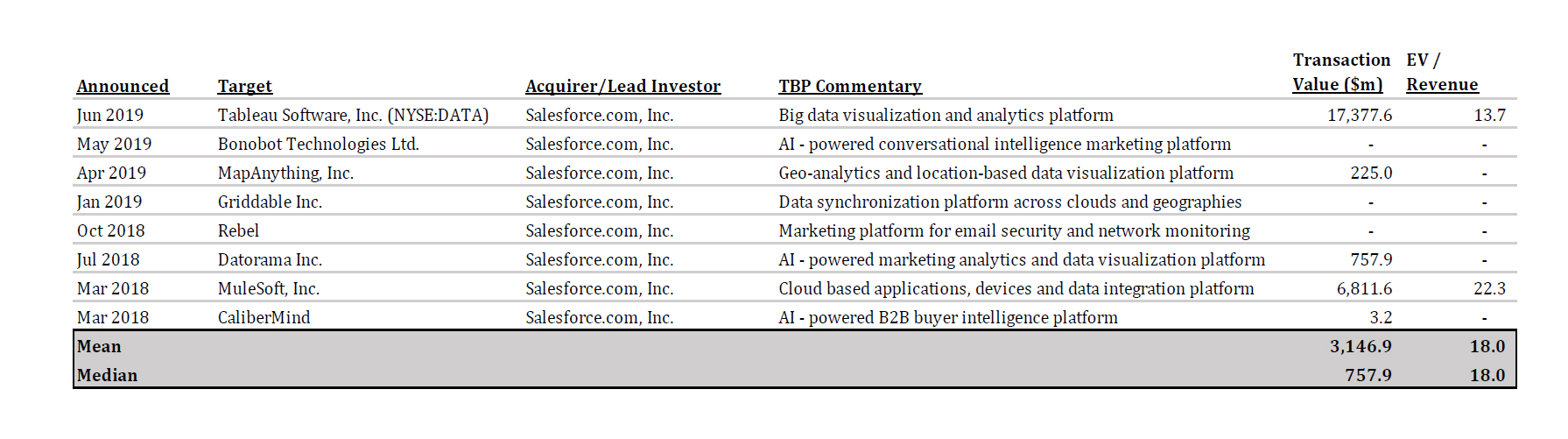

Salesforce Transaction History

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.