Salesforce.com Acquires Tableau

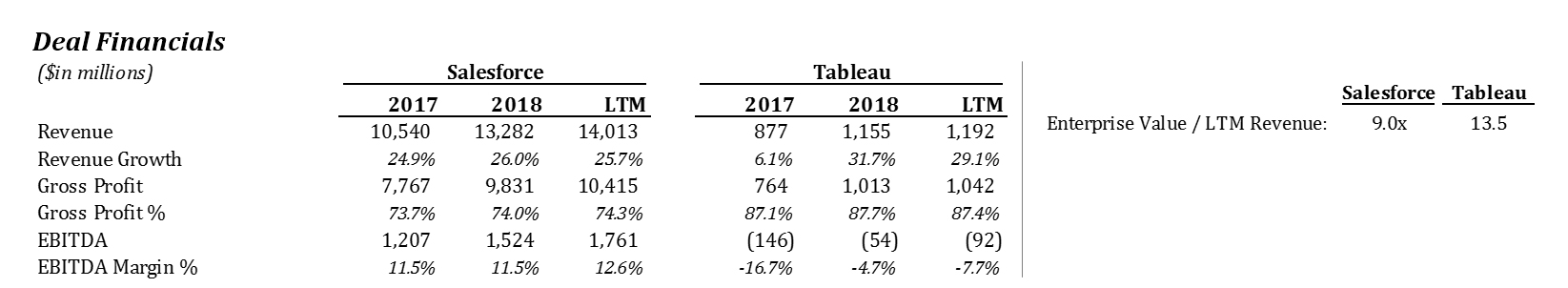

Deal Financials

Transaction Overview

- On June 10, 2019, Salesforce.com announced its $15.7 billion acquisition of Tableau, a Seattle headquartered data analytics and visualization platform provider.

- The all-stock deal involves exchanging Tableau’s Class A and Class B share for 1.103 shares of Salesforce common stock. This values the offer at $177.88 per share, a 42% premium to Tableau’s closing price on Friday.

Acquiring the #1 data analytics company as a beach-head into Digital Transformation

- A recent report from the IDC predicts global spending on technologies and services enabling digital transformation to reach $1.8 trillion by 2022.

- Tableau integrates data streams coming from multiple sources and Salesforce’s MuleSoft Anypoint platform integrates data from various systems using APIs. Together, Salesforce can hook into data coming from disparate systems within the enterprise. This will further accelerate its Customer 360 initiative, a platform that connects customers’ Commerce, Marketing and Service Cloud networks.

- Salesforce can also integrate Tableau’s capabilities into Salesforce Einstein, the AI-powered analytics for sales and marketing, to deliver an industry-leading intelligent analytics and visualization platform.

- Since Tableau has the mind-share of the corporate buyers and consumers of data-analytics, Salesforce Einstein can be the natural cross-sell/up-sell opportunity to these customers.

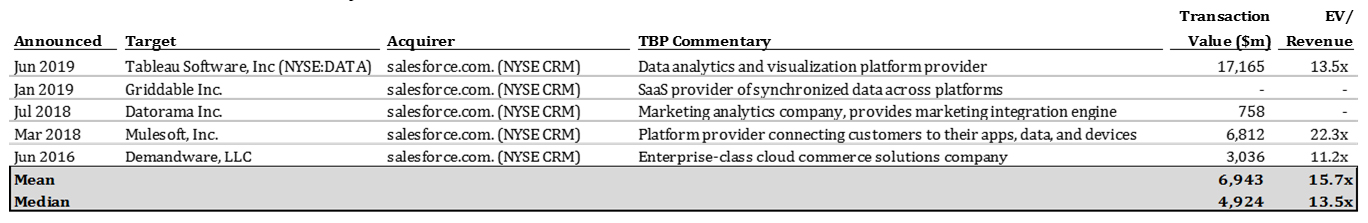

Salesforce continuing an aggressive acquisition spree

- Out of the three multi-billion dollar acquisitions Salesforce has made since June 2016, each consecutive acquisition has more than doubled in size.

- Prior to purchasing Tableau, Salesforce acquired Demandware for $3.0 billion in June 2016 and MuleSoft for $6.8 billion in March 2018.

- Salesforce has paid elevated revenue premiums for both of its last two multi-billion dollar acquisitions. The company paid 22.3x LTM revenue for MuleSoft, followed by 13.5x LTM revenue for Tableau.

- Tableau was on a list of potential Salesforce acquisition targets as early as May 2016. Since then, several of Tableau’s competitors have been acquired, including Looker by Google and Qlik by Thoma Bravo.

Salesforce Transaction History

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.