SAP Acquires CallidusCloud

Sunil Grover, Managing Partner

sgrover@truebluepartners.com

(669) 900-4031

Deal Financials

Enterprise Value ($m): 2,394.3

Enterprise Value / LTM Revenue: 10.0x

Transaction Overview

- On Jan 29, 2018, German enterprise software giant SAP announced its acquisition of CallidusCloud, a provider of cloud-based Sales Performance Management (SPM), Configure Price Quote (CPQ), and Contract Lifecycle Management (CLM) software.

- The transaction marks SAP’s expansion into the CPQ space, as well as its continued commitment to wean its customers of its antiquated on-premise model and into the cloud.

CPQ is Focus Area for Large-Cap Enterprise Software

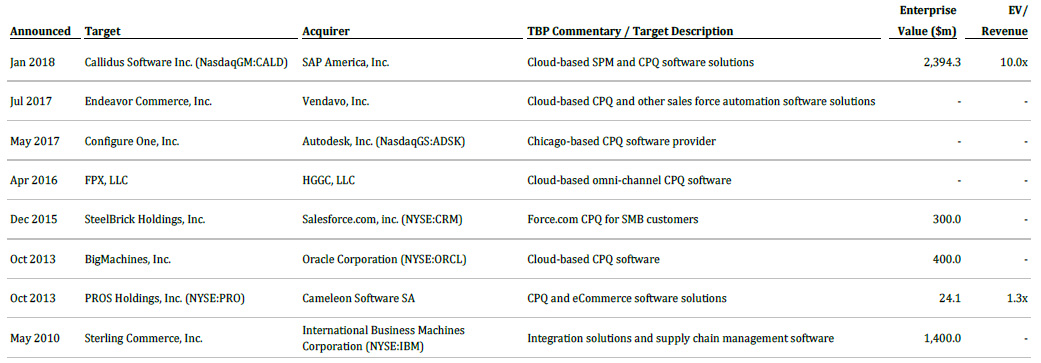

- CPQ software companies have been targets of enterprise software giants ever since IBM’s 2010 acquisition of Sterling Commerce, a supply chain management software provider with a CPQ offering.

- IBM was followed by Oracle, which acquired BigMachines in 2013, and Salesforce, which closed its acquisition of SteelBrick in 2016. See below for more CPQ-related transactions.

- In the private markets, Apttus, a CPQ player in the Salesforce ecosystem, has raised a total of $329m from investors including Salesforce Ventures, K1, IBM, ICONIQ, and PremjiInvest. Its investment round in 2016 valued the company at $1.3 billion. Read more about Apttus in TBP’s Salesforce Ecosystem Report here.

SAP’s Cloud Strategy

- Callidus, a California-based software provider founded in 1996, began converting to a subscription model in 2009, acquiring various cloud-based sales software solutions providers like Litmos and Badgeville.

- SAP began its transition in 2010, but suffered delays from things like the migration and deployment of S/4HANA. As CallidusCloud sports roughly 80% recurring revenue on its $240m revenue base, this transaction will help accelerate SAP from its current 55% predictable revenue towards its goal of 70 to 75% by 2020.

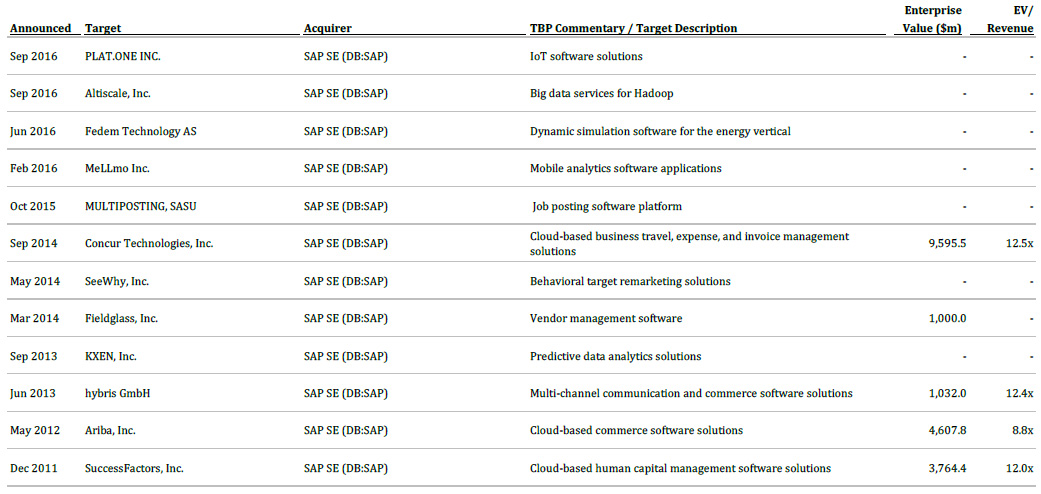

- CallidusCloud’s 21% valuation premium over its weighted 30-day stock price is consistent with premiums for public company transactions. SAP follows this trend closely with a history of paying premiums for large acquisitions. Examples include its acquisitions of Hybris for 12.4x LTM Revenue in 2013 and Concur Technologies for 13.1x LTM Revenue in 2014. See below for more of SAP’s transaction history.

Recent CPQ Transactions

Recent CallidusCloud Transactions

Recent SAP Transactions

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com