SAP SE Acquires Qualtrics

Deal Financials

| Total Transaction Value (EV) ($m): | 8,000.0 |

| EV / LTM Revenue: | ~21.1x |

Transaction Overview

- On November 11, 2018, SAP SE (DB:SAP) announced its acquisition of Qualtrics International Inc. (NasdaqGS:XM), a Utah-based experience management software provider for feedback and data analysis, for $8 billion in an all-cash deal, snapping up the company before its planned IPO. The deal playbook is similar to Workday acquiring Adaptive Insights in June and Cisco acquiring AppDynamics in 2017, when the two target companies were in the middle of the IPO process.

- To date, Qualtrics has raised a total amount of $400m, including its latest Series C round of $180m, which closed in April 2017. The round was led by Insight Venture Partners and Accel Partners and included participation from Sequoia Capital. The round gave Qualtrics a $2.5 billion post-money valuation, meaning that investors in the round exited with 3x their investment in 18 months.

Bigger and Bolder on Valuations

- This transaction marked SAP’s second-largest acquisition ever, following its $9.6 billion purchase of cloud-base travel and expense software company Concur Technologies in September 2014.

- Early this year, SAP acquired CallidusCloud, a provider of cloud-based Sales Performance Management (SPM), Configure Price Quote (CPQ), and Contract Lifecycle Management (CLM) software, for nearly $2.4 billion.

- Notably, SAP’s acquisition of Qualtrics was priced at a significantly higher revenue multiple, compared to its acquisition of Concur for 13.1x LTM revenue and CallidusCloud for 10.0x LTM revenue.

Playing Catch-up in CRM

- SAP is looking to incorporate the Experience Management (XM) capabilities of Qualtrics. These include features to capture survey data and feedback from users on customer experience, brand experience, product experience, and employee experience.

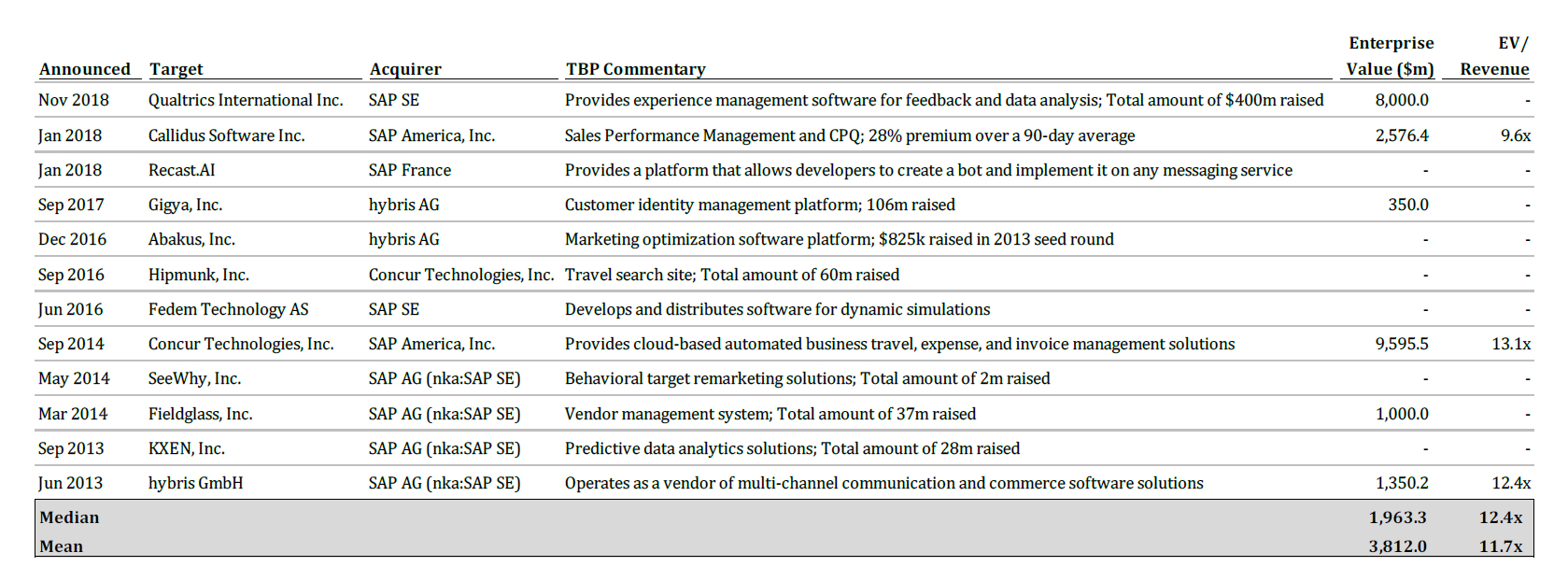

Select SAP Transactions

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.