Simplus Raises $20m Series C and Acquires Sqware Peg

Deal Financials

| Series C Transaction Value: | $20.0m |

| Enterprise Value / Revenue: | Undisclosed |

Transaction Overview

- On January 30, 2018, Quote-to-Cash-focused (QTC) Salesforce services provider Simplus announced its $20 million Series C and acquisition of Sqware Peg, an Australia-based Platinum Salesforce Consulting Partner. Salesforce Ventures is an investor in both Simplus and Sqware Peg.

- The $20m series C was led by Kensington-SV Global Innovations, and existing investors included Savano Capital, Simplus CFO Paul Fletcher (former CFO of Presidio), G2 Crowd CEO Godard Abel (former CEO of SteelBrick and BigMachines), and Salesforce Ventures.

- True Blue Partners is a co-investor in Simplus.

Simplus History

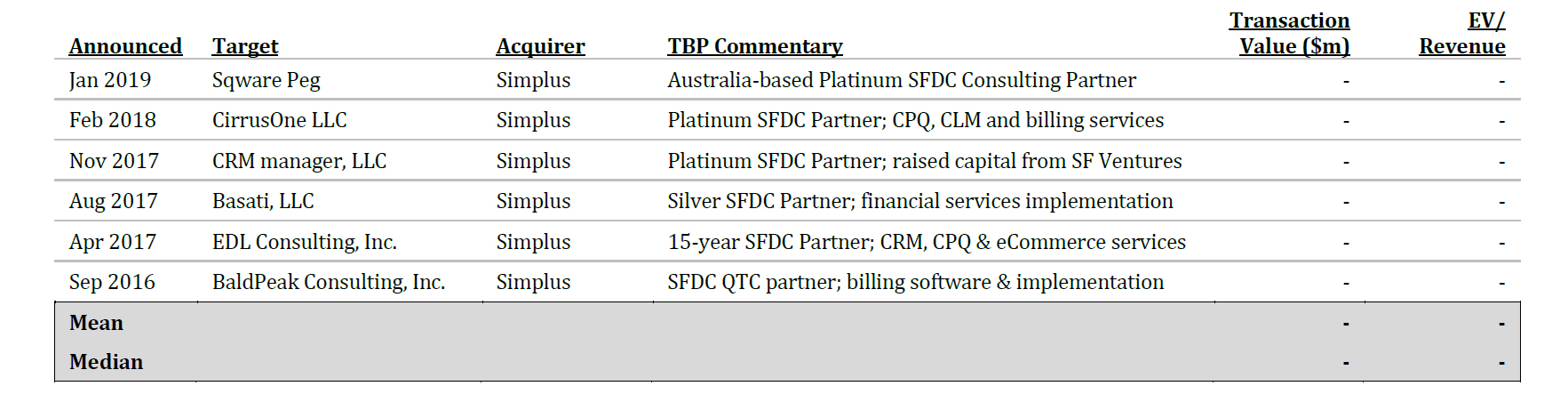

- Since its founding in 2014, Simplus has raised $62 million and acquired 6 smaller services providers.

M&A Activity Among Salesforce Services Providers Remains Robust

- In the past 2 years, over 40 Salesforce Consulting Partners have been acquired. Large IT services companies have consistently turned to M&A to grow their Salesforce practices, and as a result, independent Salesforce Consulting Partners with over $30 million in revenue have become increasingly scarce.

- In 2018, Cognizant acquired 2 Salesforce services providers, ATG and SaaSFocus. Like Simplus, ATG was a QTC-focused Salesforce Partner that received funding from Salesforce Ventures.

- In September 2018, Indian IT services giant Infosys acquired FLUIDO, a Finnish Platinum Salesforce Partner, for $76 million. In the same month, DXC Technology announced its acquisition of System Partners, a Platinum Salesforce Partner based in Australia.

- Capgemini acquired two Commerce Cloud-focused Salesforce services providers in 2017: France-based Itelios and Chicago-based Lyons Consulting Group. Both were acquired for undisclosed sums, but the latter’s 2016 revenue was $45 million according to Inc. 5000.

- More information about these companies’ transaction histories is available in TBP’s 2017 Salesforce Ecosystem Report. For the 2018 report with updated M&A and investment trends, please contact us at info@truebluepartners.com.

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.