Thoma Bravo Acquires Majority Stake in Apttus

Deal Financials

| Implied Enterprise Value ($m): | Undisclosed |

Transaction Overview

- On September 4, 2018, private equity firm Thoma Bravo announced its acquisition of a majority stake in Apttus, a provider of Configure-Price-Quote (CPQ) software built natively on Salesforce’s Force.com platform.

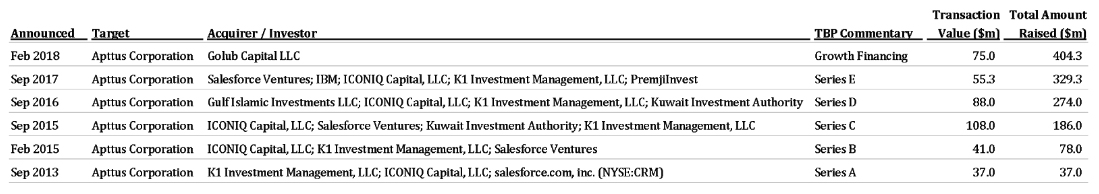

- Apttus has raised a total of $404 million from investors like Salesforce Ventures, IBM, and K1. Its most recent growth equity round was a $55 million Series E led by PremjiInvest last September, which valued the company at $1.8 billion.

- Apttus was openly preparing to go public since 2016 and claimed to have completed over half of the related preparations in 2017. However, founding CEO Kirk Krappe abruptly left the company two months ago, and Thoma Bravo’s majority investment has largely removed the possibility of an IPO in the near future.

- Upon Krappe’s departure, George Kadifa was appointed as Chairman of the Board. Interestingly, he and Krappe have both previously held positions at Corio, where they were CEO and SVP, respectively, throughout Corio’s IPO in 2000.

Continued Investments in CPQ

- The CPQ software space has seen a steady increase in transaction activity in recent years, with participation from both strategic and private equity buyers.

- A recent CPQ transaction was SAP’s acquisition of sales performance management and CPQ software provider CallidusCloud for $2.4 billion in January. Formerly traded on the NASDAQ under the ticker CALD, CallidusCloud has since become a key part of SAP’s recently unveiled C/4HANA, a suite of cloud-based CRM software solutions.

- Another notable transaction in the space was Salesforce’s acquisition of Steelbrick for $300 million in December 2015. Like Apttus, Steelbrick provided Salesforce-native CPQ software and received investment from Salesforce Ventures.

- Five months after Salesforce acquired Steelbrick, Apttus migrated from Force.com and broke into the Microsoft ecosystem. The company released a new version of its existing application suite with machine learning capabilities powered by Azure. Read more about Apttus’ multi-platform strategy in our Salesforce ecosystem report.

- Other recent CPQ transactions include Vendavo’s acquisition of EndeavorCPQ in July 2017 and private equity firm HGCC’s acquisition of FPX in May 2016.

Continued Investments in the Salesforce Ecosystem

- As ecosystem-focused software and services companies continue to shed the stigma of vendor dependency, private equity firms have become increasingly active in acquiring Salesforce-focused companies.

- In March, Pamlico Capital invested in SilverlineCRM, a Salesforce consulting partner focused on the Financial Services and Health Clouds. Another Salesforce consulting partner, Astadia, received a majority investment from Spring Lake Equity Partners and New Harbour Partners in July.

- Notably, from Q4 2017 to Q1 2018, Insight Venture Partners portfolio company Bullhorn acquired three recruiting software providers with products built natively on the Salesforce platform.

Apttus Investment Rounds

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.