AST Receives Strategic Investment from Recognize

Deal Financials

- Transaction Value: Undisclosed

- Enterprise Value / Revenue: Undisclosed

Transaction Overview

- On January 24, 2022, AST Corporation, a leading cloud and digital transformation services provider received a strategic growth investment from Recognize, a technology services-focused investment platform.

- Recognize was co-founded by Chuck Phillips (former CEO of Infor, President Oracle, and MD, director Morgan Stanley) and Francisco D’Souza (CEO of Cognizant) among others. Chuck Phillips will serve as Chairman of the Board of AST going forward.

TBP’s Analysis of AST Corporation’s Growth via Partnership and Acquisition

- AST Corporation has been a long-standing provider of Oracle application and implementation services and is one of the leading implementation partners for Oracle Cloud ERP.

- In 2015, AST acquired Serene Corporation, to strengthen its CRM/CX cloud implementation capabilities and add Salesforce capabilities. (Transaction advised by TBP Managing Partner at a different firm)

- In 2017, AST partnered with Oracle to become an Oracle Cloud Managed Services Provider. This enabled AST to become a one-stop-shop for all Oracle solutions including Infrastructure as a Service (IaaS), Platform as a Service(PaaS), and DevOps Management.

- In the same year, AST corporation announced its recapitalization by Tailwind Capital which positioned it to be to become a leading cloud and digital transformation services provider. (A transaction advised by TBP Managing Partner at a different firm)

TBP’s Analysis of Strategic and Financial Sponsors interest in the Oracle Ecosystem

- There has been a recent uptick in M&A activity for Oracle service providers with a repeated trend where companies are seeking the support of financial sponsors before/after making strategic acquisitions.

- 2021 saw Oracle equity value almost double driven by the Oracle cloud business.

- For Example, in April 2020, Accelalpha, which provides implementation services for Oracle cloud applications got recapitalized by Century Park Capital Partners, and within a year, in April 2021, it acquired Key Performance Ideas, an Oracle EPM solution provider.

- Several IT Services companies have used acquisitions as a means to fuel their growth.Several IT Services companies have used acquisitions as a means to fuel their growth.

- Nov 2021, Datavail Corp acquired Skybridge Global (ERP and BI solutions)

- Sep 2021, CherryRoad acquired Infosemantics to add to its Oracle capabilities (A TBP transaction)

- Jan 2021, Cognizant acquired Linium, an Enterprise Performance Management (EPM) solution provider.

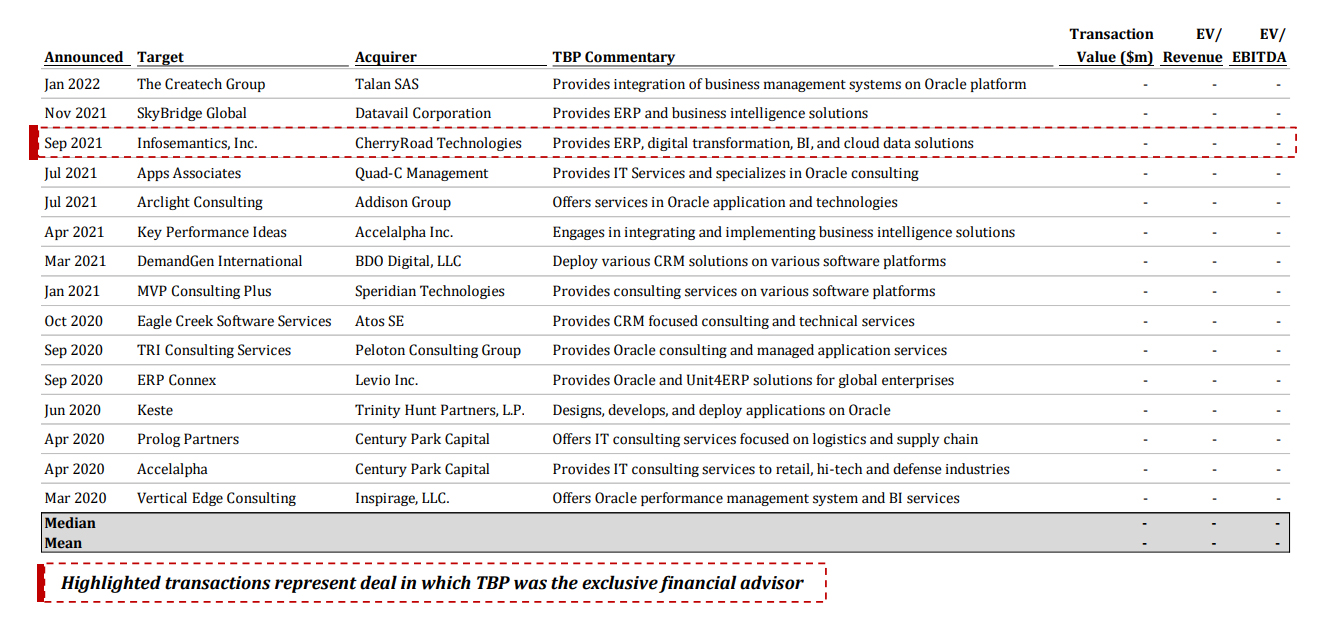

- Other related transactions are outlined in the table below.

TBP’s Analysis of Leading Companies Exploring Salesforce After its Success on Oracle Platform

- In an inorganic growth strategy similar to AST Corp, other companies have used acquisitions to build their Salesforce practice.

- Apps Associates, an enterprise application services leader that started as an Oracle Partner have now extended all its services on Salesforce Platform and has become Salesforce Certified Architect.

- A5 Corporation, a leader in digital transformation and full-service solutions provider started as an Oracle Platinum Partner and then pivoted to Salesforce capabilities in Campaign to Cash and established its leadership on the Salesforce Platform.

Notable M&A Transactions within Oracle Ecosystem

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.