E2open (NYSE:ETWO) Acquires Logistyx

Deal Financials :

Transaction Value: $185.0 M

Enterprise Value/ Revenue: 4.6x

Transaction Overview

- On March 7, 2022, E2open Parent Holdings, Inc. acquired Logistyx Technologies, a supply chain management software company focused on shipping and transportation for $185M

- E2open is a B2B cloud-based and end-to-end supply chain management SaaS platform provider. Their software enables enterprises to optimize supply chain channels by employing networks, data, and applications, as well as supporting efficient collaboration of business planning, global trade management, and supply chain logistics

- Through this acquisition, E2open effectively improves efficiency across the supply chain network, gaining both documentation and consolidation solutions along with additions in software implementation and maintenance

E2open Returns to Acquisitions

- As E2open’s stock struggles to recover from recent lows, the company completes the acquisition of another international TSM enterprise

- Logistyx further establishes E2open as a premier company in TMS/SCM, especially as the company will also gain benefits in data and business intelligence.

- The 2021 acquisition of BluJay Solutions by E2open to improve its efficiency and reduce risk in supply chain logistics was a marked success. The company had since, until this development, been inactive in converting acquisitions to fuel growth

- From 2017 to 2019, E2open had made several notable transactions to solidify its platform’s capabilities in TMS and SCM. During this span, E2open had completed seven strategic acquisitions in supporting their end-to-end supply chain functions

- In 2019, E2open acquired Averetek and Amber Road, with the latter being a cloud-based solutions provider. The Amber Road deal facilitated E2open’s growth in import & export management, global sourcing, and production management

- In 2018, E2open acquired Inttra, Cloud Logistics, Birch Worldwide, and Entomo, software solutions companies that emphasized ocean freight booking, TMS, and distribution channel solutions, respectively. These transactions worked to expand E2open’s capabilities in streamlining and standardizing shipping processes

- The sole transaction of 2017 for E2open was the acquisition of Steelwedge Software, a cloud-based provider of integrated business planning solutions aligning product sales, demand, supply across channels, time horizons, and geographies

Global Supply Chain Shocks and Challenges in TMS

- The need for efficient supply chain management systems with supply chain disruptions is evident

- After COVID-19 there was a distinguishable uptick in M&A activity in the SCM/TCM industry, with valuation multiples also increasing

- While many supply chain disruptions that arose from COVID-19 have been mitigated, the ongoing conflict in Ukraine, coupled with greater variance in foreign exchange rates, has presented issues of its own

- International trade will be in an unusual position given supply shocks to commodities, unprecedented inflation rates, and the increasing relative strength of the US dollar

- As identified in previous analyses, there remains strong demand for same-day-delivery and increased transparency with shipping

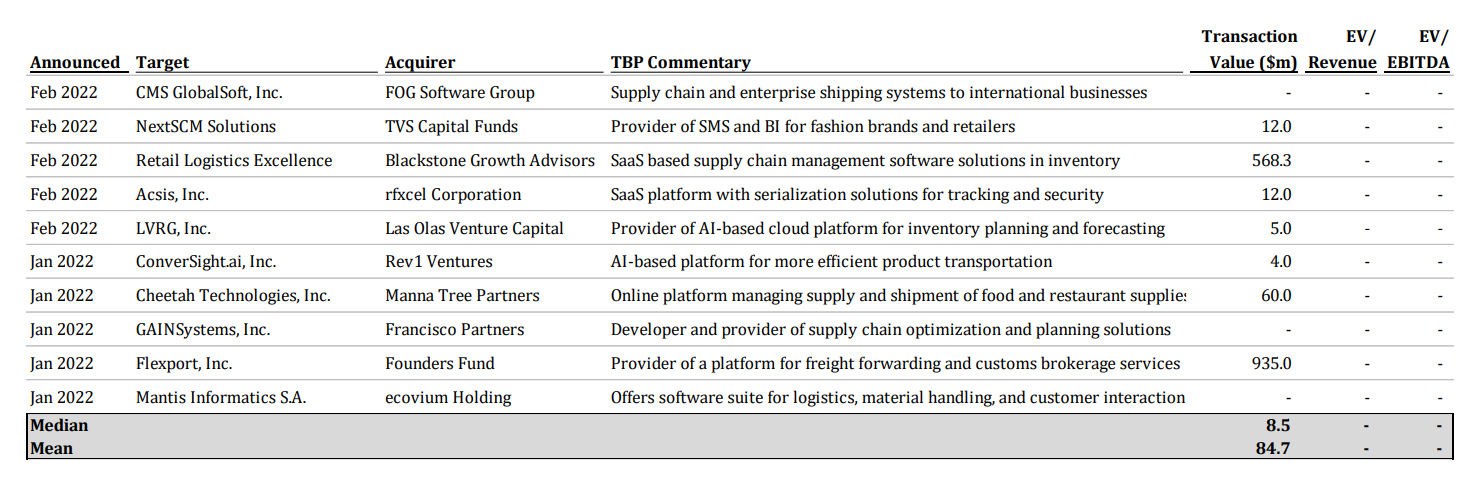

SCM M&A Transactions in 2022

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.