Togetherwork acquires Fonteva

Deal Financials

- Enterprise Value: Undisclosed

- Enterprise Value / Revenue: Undisclosed

Transaction Overview

- On February 10, 2021, leader of group management software and payments solutions Togetherworks announced its acquisition of Fonteva, a Salesforce.com native and leading provider of cloud-based membership and events management software. GI Partners is the financial sponsor of Togetherworks.

- Togetherwork’s acquisition of Fonteva brings deep Salesforce expertise to enhance product and payments capabilities into its family of companies that provide software to member-based organizations.

- True Blue Partners was an investor in Fonteva since 2018 and subsequently organized a multimillion-dollar coinvestment syndicate in 2019.

- This transaction marks another successful exit for TBP in salesforce ecosystem with less than 3-year hold period.

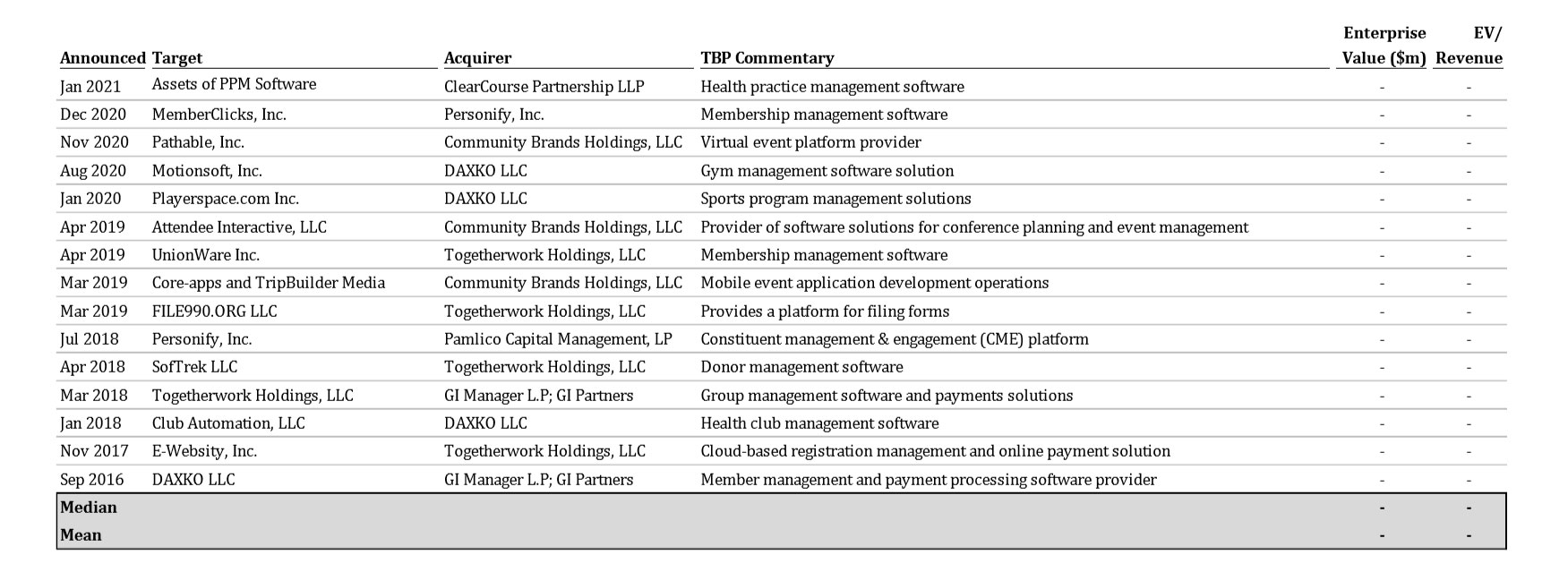

PE-Backed M&A Activity in Member-Based Software Providers

- In Sep 2016, GI Partners acquired Daxko, a member management and payment processing software provider from Pamlico Capital for an undisclosed amount. Daxko went on an M&A spree, acquiring seven membership management software solutions.

- GI Partners acquired Togetherwork in Mar 2018 from Acquiline Capital Partners. Through its sponsor, Togetherwork has made a total of eight acquisitions in member-based management software providers, Fonteva being the ninth.

- Notably in Nov 2018, Aquiline Capital Partners acquired ClearCourse Partnership, a provider of membership software. ClearCourse proceeded to make 22 member-based software acquisitions via its sponsor, with its latest in Jan 2021.

- Pamlico Capital, along with HarbourVest Partners, acquired another member-based platform, Personify, a constituent management & engagement (CME) platform in Sep 2018. In Dec 2020, Personify announced its acquisition of MemberClicks, a member management platform for associations and local chambers in Dec 2020.

- Fonteva was the largest Salesforce native memberships and events management software during Togetherworks’ acquisition announcement.

M&A and Investment Activity in Salesforce Partnered Software Providers Remain Robust

- In May 2020 Apttus, a Salesforce native Configure-Price-Quote (CPQ) software, acquired Conga, a cloud-based document generation and reporting applications provider for Salesforce customers. Prior to this acquisition, Conga raised $47m in venture capital from firms including Insight Venture Management LLC and Salesforce Ventures.

- In Aug 2020, Cirruspath, a provider of software application that integrates Salesforce CRM with different email platforms, acquired ZynBit.com, a Salesforce based sales engagement software provider. Prior to this acquisition, ZynBit.com raised $2.5M in capital from River SaaS Capital and various accredited investors.

- In Sep 2020, ClickDeploy, a Salesforce App Exchange Partner and provider of Salesforce release management & DevOps platform, was acquired by Copado.

- More recently in Nov 2020, Druva acquired sfApex, a provider of Salesforce cloud backup, disaster recovery, and data migration tools for CRM platform.

- Also in Nov 2020, Precursive Ltd. Acquired Tapply Limited, a customer onboarding and capacity management platform provider on Salesforce.

- The M&A landscape for Salesforce partnered software providers remain strong as companies across all verticals have consistently turned to M&A to grow their Salesforce capabilities and practices.

True Blue Partners’ Investment in Fonteva

- True Blue Partners was an early co-investor in Fonteva, subsequently organizing its growth equity syndicate financing.

- TBP has made investments in other Salesforce ecosystem focused companies like Full Circle Insights (Force.com ISV), OSF Digital (Commerce Cloud Consulting Partner), and Simplus (CPQ focused digital transformation services provider).

- TBP invested in and organized a $23 million co-investment syndicate for OSF Digital that included investment from Delta-V Capital and Salesforce Ventures.

M&A Activity within the Event Management Space

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

TBP was a co-investor in Fonteva.