Zoom Signs Definitive Agreement to Acquire Five9

Deal Financials

- Transaction Value: $14.6B

- Enterprise Value / Revenue: 30.5x

- Enterprise Value/EBITDA: N/A

Transaction Overview

- On July 18th, 2021, Zoom Communications announced its acquisition of Five9, a provider of cloud contact center software, valuing the company at $14.6 billion in an all-stock transaction at a conversion rate of 0.55 share of Zoom for each share of Five9.

- This deal marks Zoom’s first billion-dollar-plus acquisition.

- This is the second-biggest U.S. tech deal of the year, behind Microsoft’s acquisition of Nuance for $19.7B.

TBP’s Outlook on Post Pandemic World of Communication Technology

- Covid-19 has accelerated the demand for AI-powered communication technology services as it forced global adoption of work from home and other remote working models.

- Call Center agents will continue to return to contact centers’ locations, but they are not all coming back.

- Some organizations have already made the decision to keep contact centers remote indefinitely and others will operate in a hybrid capacity due to employee preference, costs, and ROI.

- This creates a demand for new cloud-based capabilities to support a distributed workforce in the contact center.

- Microsoft provides Azure cognitive services for text translation and sentiment analysis. Its recent acquisition of Nuance has strengthened its existing platform by adding cloud and AI capabilities of Nuance in Conversational AI.

- Salesforce acquired Slack to combine its CRM platform with the most innovative communication platform to transform the way everyone works in the all-digital, work from anywhere world.

- With the future of work trending towards a hybrid work model, communication SaaS providers are in high demand and have seen a massive uptick in the valuation multiples after the outbreak of Covid-19 as covered in our recent analysis of valuation drivers in SaaS

TBP’s Outlook on Zoom’s Strategy to be a Leader within the Communication Software Providers

- With over 400,000 accounts with over 10 paying users per account, Zoom is the leader of the video conferencing race.

- With this transaction, Zoom repositions itself as a leader in communication technology provider across many different channels.

- In 2019, Zoom launched Zoom Phone, a modern cloud phone system, and has surpassed more than 1.5 million licenses in less than 2 and a half years. The acquisition of Five 9 will help Zoom build and strengthen its Zoom Phone services.

- Zoom also launched a $100 million Zoom Apps fund to invest in the company’s ecosystem of Zoom apps and integrations.

- Zoom Apps is different from the 800 apps that are currently offered on the Zoom marketplace. Zoom’s existing marketplace revolves around integrating Zoom with other applications, while Zoom Apps will be more deeply integrated with the Zoom interface for a better overall experience.

- The growth within the space is evident by the share price performance of Zoom which has surged more than 5x since its IPO in April 2019.

- As Zoom continues to build its developer ecosystem, the acquisition of Five9 positions Zoom to be a one-stop solution for all customer engagement needs. This will threaten to replace legacy systems like Cisco, Avaya, Mitel (now Rackspace), Genesys, etc, and help become a more specialized competitor to Microsoft Teams and Google Meet.

TBP’s Investment in Communication Technology Providers

- TBP was an early investor in Observe.ai, which provides contact center AI to transform customer experiences.

- TBP led the $9 million Series B financing of 3CLogic, a leading cloud-based contact center solution provider deeply integrated with ServiceNow and Microsoft Dynamics.

- TBP is an early investor in Quark.ai which is implementing deep learning and NLP technologies to provide customer support.

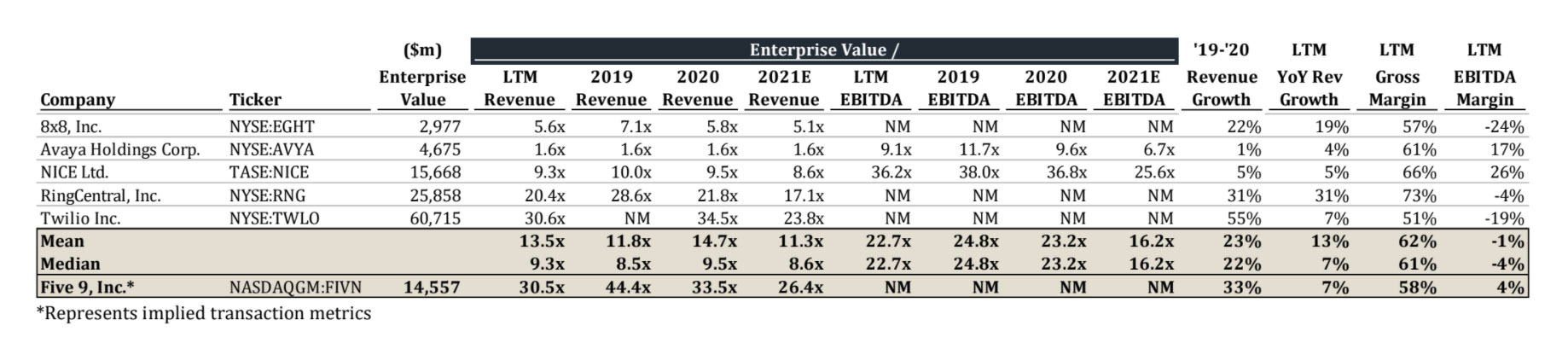

Comparable Public Companies

M&A Activity in the Contact Center Software and Services Provider

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.