Panasonic Acquires Blue Yonder

Deal Financials

- Transaction Value: $7.1B

- Enterprise Value / Revenue: 8.5x

- Enterprise Value/EBITDA: 35.0x

Transaction Overview

- On April 23, 2021, Panasonic agreed to buy the remaining 80% of shares of Blue Yonder for $5.6 billion and repay existing outstanding debt of Blue Yonder. Panasonic originally acquired a 20% stake in Blue Yonder back in July 2020.

- Blue Yonder is a digital fulfillment platform provider whose software applications are widely used in supply chain planning and execution. Blue Yonder was formerly known as RedPrairie that was re-named as JDA Software Group after its acquisition of JDA Software Group for $2.3B in 2012.

- This acquisition is a result of a two-year strategic relationship, first with Panasonic as a customer of Blue Yonder and thereafter as a joint venture partner with Panasonic having 20% equity ownership in Blue Yonder.

- Post-acquisition, Blue Yonder’s brand will be retained and its business will function within the Panasonic Connected Solutions Company umbrella.

TBP Observes Panasonic Accelerating its Mission of Autonomous Manufacturing Supply Chains

- In 2019, Panasonic and Blue Yonder (then called JDA Software) collaborated to integrate Blue Yonder’s supply chain software using IoT and edge technologies with Panasonic’s connected manufacturing and logistics technology.

- In retrospect, this was a try-before-you-buy initiative to combine intelligent and autonomous manufacturing strategies with improved supply chain visibility and planning.

- As a result of the COVID-19 pandemic, the market demand for an intelligent and autonomous supply chain has accelerated.

- Manufacturers across all industries are increasingly relying on industrial automation solutions, including robotics and artificial intelligence with a focus on optimizing supply chain in overall operations.

Digital Supply Chain Management M&A Activity Remains Robust

- COVID-19 demonstrated the necessity of a flexible and agile supply chain with end-to-end visibility through the adoption of a digital and technology-driven approach.

- Accenture expressed its interest within the Blue Yonder ecosystem by acquiring Gold Partner REPL Worldwide in March 2021. Through REPL’s deep relationship with Blue Yonder, Accenture meets the demand for cloud-based solutions in this ecosystem and further strengthens its supply chain capabilities within the retail industry.

- In December 2020, Elemica’s acquisition of ProcessWeaver, the leading first-to-final mile multi-carrier parcel TMS solution provider, demonstrated advances to bolster its supply chain management capabilities.

- In November 2020, Coupa Software acquired Llamasoft, an AI-powered supply chain design and planning company. LLamasoft’s deep supply chain expertise and capabilities provide organizations with instant visibility, agile planning, and timely risk mitigation support.

- In October 2020, CC Neuberger Principal Holdings I announced its special purpose acquisition of E2 open. E2open’s leading end-to-end and cloud-based SaaS platform accelerates growth, reduces costs, increases visibility, and drives improved resiliency across supply chains.

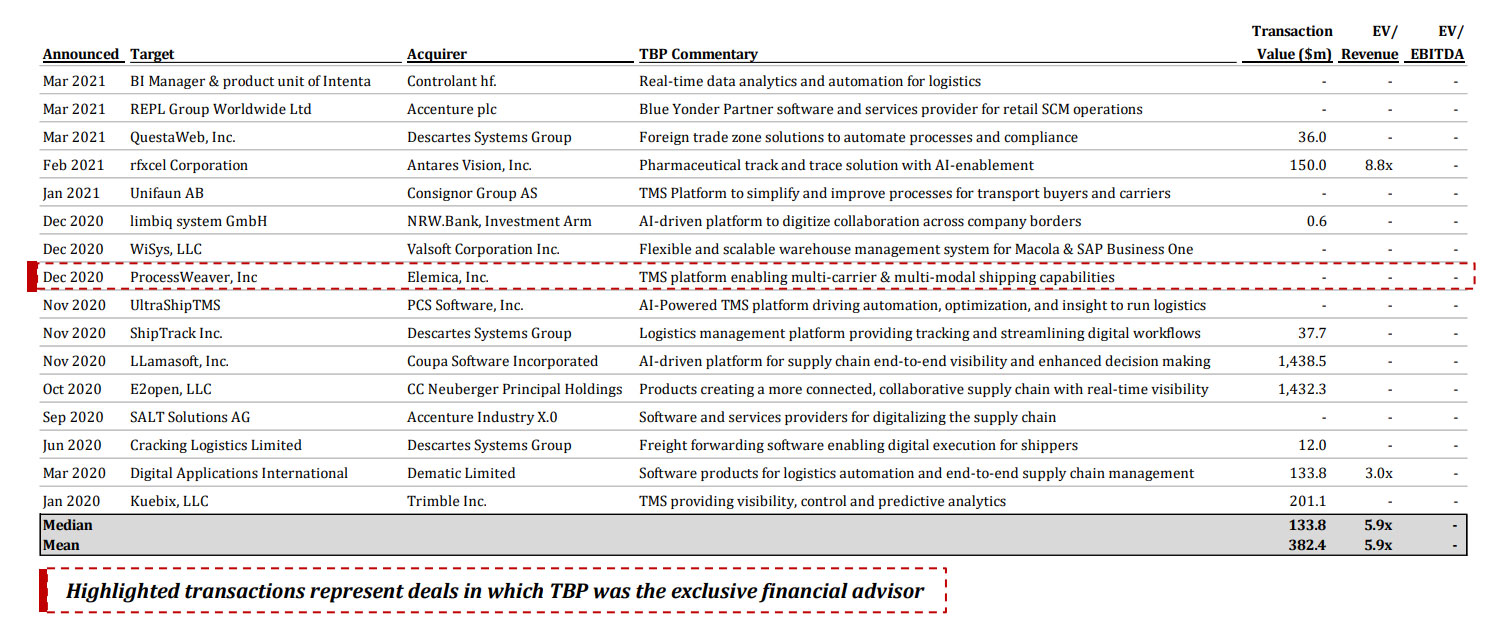

Notable Digital Supply Chain Company Transactions

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.