Blackstone to acquire additional stake in Mphasis

Deal Financials

- Transaction Value: $1.1B

- Enterprise Value / Revenue: 3.2x

- Enterprise Value/EBITDA: 17.4x

Transaction Overview

- On April 26, 2021, Blackstone announced its offer to acquire an additional 26% stake in Mphasis for $1.1 billion.

- This acquisition followed an earlier investment in 2016 wherein Blackstone acquired a 60.5% equity interest in Mphasis from Hewlett Packard to capitalize on the high growth potential of the IT services industry.

- Mphasis offers IT outsourcing services to global companies, including cloud computing services and digital processes for business.

TBP’s analysis of Blackstone doubling down on its five-year investment

- Blackstone Capital Partners (BCP) recognition for technology-driven solutions and the increased needs for outsourced services amidst the COVID-19 pandemic influenced them to grow their investment in Mphasis.

- In 2016, BCP acquired a 60.5% stake in Mphasis, as companies shifted to high-profit margin digital services, a category in which Mphasis showed to be a strong player. This acquisition marked BCP’s biggest investment the company has ever made in India.

- Two years later, in 2018, BCP sold an 8% stake to create liquidity and bring in additional high-quality investors. In 2020, BCP again acquired an additional 4% stake to continue being the long-term majority shareholder.

- BCP recently committed $2.8 billion to buy up to 75% of the company and will be joined by its limited partners, sovereign funds, and marquee US endowments.

- Mphasis has been a notable investment for BCP, which has tripled to $4.5 billion in market cap 5 years after its acquisition.

- According to Bloomberg, Blackstone is confident to take Mphasis from the current $4.5 billion to $10 billion in the next 4 years based on the current technological demands.

Private Equity’s appetite for IT services firms remains robust in 2021

- Private Equity/Venture Capital firms have invested $51.05 million on average for 223 deals in IT services that happened in India, Europe, and North America in the first four months of 2021.

- The average value of an investment in 2021 was 27% lower than the immediate previous quarter, which saw an average of $70 million being invested across 160 deals.

- In April 2021, KKR acquired Ensono, a company providing a comprehensive suite of services that helps enterprises manage, optimize and modernize their IT systems across mainframe, cloud, and hybrid infrastructure.

- In March 2021, Apax Partners acquired Lutech, an Italian IT services and software company specializing in digital customer engagement and next-generation IT infrastructure.

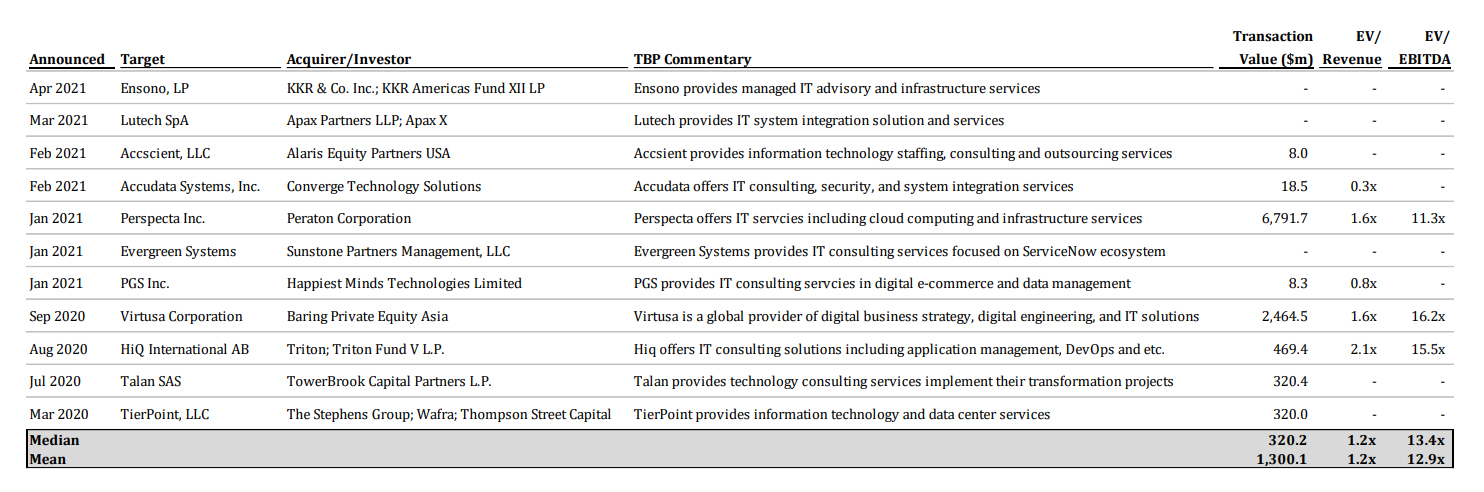

Investment activity in IT services

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.