Zuora Raises $400 million from Silver Lake

Deal Financials :

Transaction Value: $400M

Transaction Overview

- On March 2, 2022, Zuora Inc, the leading cloud-based subscription management platform provider announced a $400m strategic investment from Silver Lake

- This investment will empower Zuora to accelerate growth via acquisitions to expand its current product portfolio as well as introduce new offerings.

TBP’s Analysis of Momentum in the Subscription Economy and Zuora’s Strategy

- Subscription has become one of the leading models of today’s increasingly digital economy

- As a result of the pandemic, some subscription businesses have seen a positive impact, others have experienced a revival, and some have faced challenges.

- Overall, there has been an increase in subscription growth rate across the majority of the industry verticals including Consumer Goods & Services, Digital Media & Entertainment, and Software

- A recent report from UBS estimates that the subscription economy will reach USD 1.5 trillion by 2025 more than double the addressable market size in 2020

- The digital economy and service-oriented consumer habits are forcing companies to change their approach to look for subscriptions as an exciting growth model

- Zuora’s CEO Tien Tzuo quoted that M&A is on ‘top of mind’ as valuations come down.

- With this funding, Zuora will focus on tuck-in acquisitions which will enable new features in existing products or introduce brand-new product offering

M&A and Investment Activity Remains Robust in Payment/Subscription Management Space

A consistent trend has been seen among companies providing subscription management solutions where they raise money and then get acquired in less than a year at a premium valuation

- Witesand System raised $12.5 in June 2021 and got acquired by Juniper networks in Feb 2022

- Truebill raised $45m in May 2021 and got acquired by Rocket companies in December 2020

Two $1B+ acquisitions were reported within the space by $15B+ market cap companies

- Bill.com (NYSE: BILL) acquired DivvyPay for $2.5B in May 2021

- Rocket companies (NYSE: RKT) acquired Truebill for $1.275B in December 2021

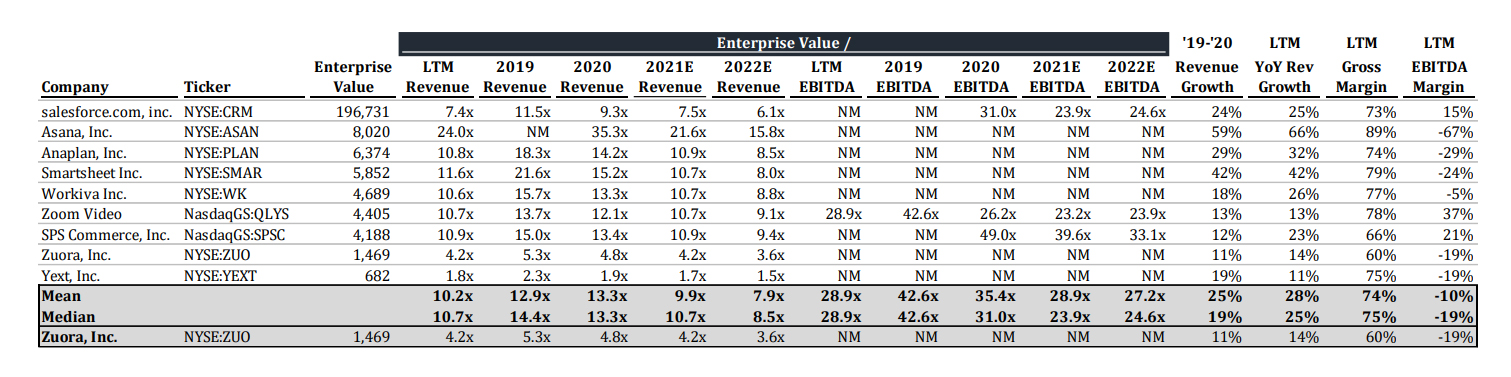

Public Comparables

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.