E2open (NYSE:ETWO) Acquires BluJay Solutions

Deal Financials

- Transaction Value: $1.7B

- Enterprise Value / Revenue: Undisclosed

Transaction Overview

- On May 27th, 2021, E2open Parent Holdings, Inc. acquired BluJay Solutions, a leading cloud-based logistics execution platform provider for $1.7B.

- E2open is a B2B cloud-based and end-to-end supply chain management SaaS platform provider. The software allows enterprises to optimize supply chain channels by using networks, data, and applications, as well as enables efficient collaboration of business planning, global trade management, and supply chain logistics.

- Through this transaction, E2open plans to improve efficiency and minimize risk along the supply chain network using data analytics and increase data visibility for transportation, warehousing, commerce, and other related industries in global trade.

E2open’s Acquisition-Fueled Growth

- In recent years, E2open has made a few notable transactions to solidify their platform’s capabilities in TMS/SCM.

- In 2019, E2open acquired Amber Road, a cloud-based solutions provider, in a $425M LBO with its financial sponsors. This deal facilitated E2open’s growth in import & export management, global sourcing, and production management.

- In late 2018, E2open acquired Inttra, a developer of ocean freight booking platform for the ocean shipping industry, which allowed E2open to expand their capabilities in streamlining and standardizing shipping processes.

- The Company also acquired Cloud Logistics in 2018 which enhanced their ability to manage complex distribution channels, simplify carrier selection, and load tendering while increasing visibility and offering real-time reporting.

BluJay – Using Capital from Investments to Fund Acquisitions

- In 2018, prior to the acquisition by E2open, BluJay secured over $500M of capital from various investment firms including TPG Specialty Lending, BlueBay Asset Management, and Temasek Holdings to pursue inorganic growth strategies.

- Most recently in May, the Company announced its acquisition of Raven Logistics, a TMS solution provider focused on rail transportation, as part of its strategy to strengthen its end-to-end multimodal transportation solutions.

- In March 2020, BluJay acquired Expedient Software, an Australian-based logistics software company that specializes in customs clearance and forwarding software for container management, workflow, and trace functionality.

- Additionally, the acquisition of ERA Systems in 2018 aimed to place BluJay as the global leader for integrated customs solutions within the transportation management space.

- These acquisitions were spread out across the globe, dramatically expanding BluJay’s global reach beyond their existing presence in the US and UK, enabling them to grow and become a prominent company in the TMS/SCM industry.

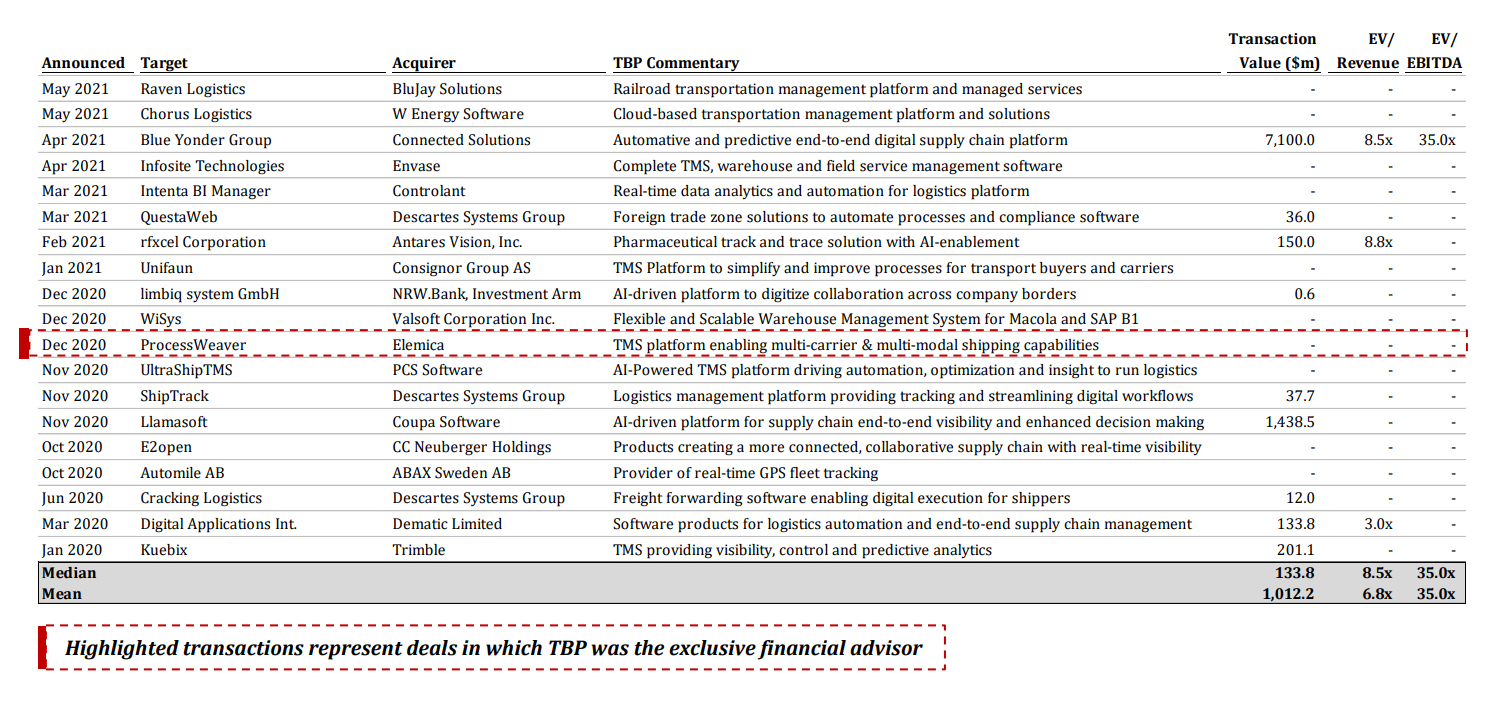

TBP’s Analysis of M&A in the Supply Chain Marketplace

- There has been a recent uptick in M&A activity within the SCM/TMS industry, with valuation multiples steadily increasing as well. Many companies have been realizing the need for optimized transportation management systems due to supply chain disruptions caused by COVID-19.

- Dubbed the “Amazon Effect,” shoppers are conditioned to expect same-day delivery and an increase in transparency with shipping. This has propelled innovation and the need for data transparency within enterprises to optimize processes and minimize costly mistakes.

- Larger players such as Descartes and WiseTech have been acquiring SCM & TMS companies, including BestTransport, CargoGuide, CargoSphere, Trinium, and SmartFreight, all of which are covered in previous TBP spotlights.

- Notably, the Llamasoft acquisition for $1.4B by Coupa Software, as well as Blue Yonder for $7.1B by Panasonic, showcase the increase in transaction size in recent years.

- More recently in Dec 2020, Elemica acquired ProcessWeaver, a leading first-to-final mile multi-carrier parcel TMS solution provider, where TBP was the exclusive financial advisor to ProcessWeaver.

Recent M&A Transactions in TMS

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.