M&A Trends in Enterprise AI – 2021 Review

2021 Overall M&A Trends

- In 2021, global M&A volumes reached $5.9 trillion in value – a 64% increase from 2020. Deal volume in US targets grew by 82% as compared to 2020 reaching $2.6 trillion in 2021 accounting for 44% of worldwide M&A activity.

- M&A activity in the technology sector was driven by accelerated digital transformation initiatives spurred by remote work during the pandemic and the resulting shift to the hybrid work environment.

AI Market Growth and Demand for Talent

- The global AI market size is projected to grow from $47.47 billion to $360.36 billion at a massive CAGR of 33.6% from 2021 to 2028 (source: Fortune Business Insights).

- Gartner forecasts the worldwide artificial intelligence software market to reach $62 billion in 2022

- Increasing business efficiencies and improving customer services are the two main factors driving the adoption of AI across all industry verticals.

- The rapid adoption of AI driven technologies has resulted in high demand for companies having core AI capabilities including general Machine Learning, Deep Learning, and Natural Language Processing.

2021 M&A Activity in Enterprise AI

2021 was a record-breaking year for M&A activity in Enterprise AI, with large strategic buyers as well as financial buyers focused on acquiring targets with AI and data science expertise.

- Microsoft acquired Nuance for a whopping $19.7B to enhance and add new AI capabilities in healthcare.

- Thoma Bravo acquired Medallia for $7.1 billion, which uses proprietary AI technology to reveal insights.

- Zoominfo acquired Affectlayer for $575 million, which provides insights from sales conversations using ML.

- LivePerson acquired VoiceBase Inc for $120 million, an AI-powered voice analytics company.

Consulting companies have shown great interest in acquiring companies that have AI-powered analytics capabilities.

- Deloitte Canada acquired Dataperformers, an applied artificial intelligence software solution provider.

- Boston Consulting Group acquired Solution Seeker, an AI-based analytics and optimization software provider.

- PWC acquired Westphalia Datalab, an AI-based platform that optimizes, automates, and forecasts sales, out-of-stock, and overstock situations.

Rapid advancements in AI have made it difficult for the global workforce to keep up with the technology. This has resulted in a shortage of talented AI professionals which in turn have given rise to increased acqui-hire activity.

- Twitter acquired Reshuffle, a provider of AI services for language and computer vision.

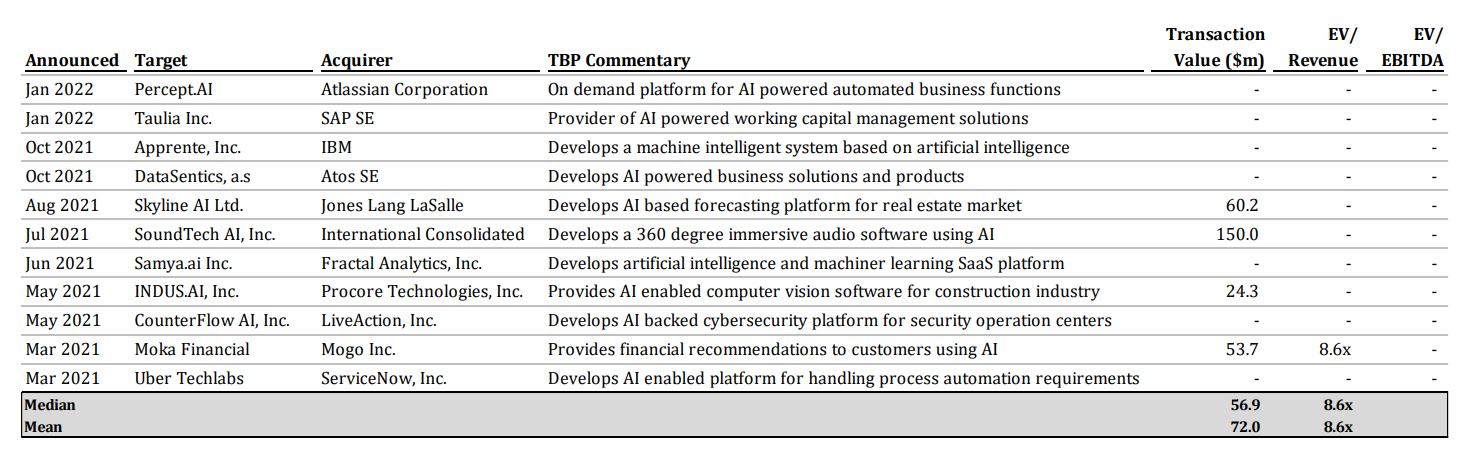

Notable M&A Transactions

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.