Uber Freight to Acquire Transplace

Deal Financials

- Transaction Value: $2.25B

- Enterprise Value / Revenue: Undisclosed

- Enterprise Value/EBITDA: Undisclosed

Transaction Overview

- On July 22nd, 2021, Uber Freight entered into a definitive agreement to acquire Transplace for $2.25 billion, consisting of $750 million in the common stock of parent company, Uber Technologies, Inc (NYSE: UBER) and the remainder in cash.

- The combination of Uber Freight and Transplace will result in a fully-scaled logistics platform to meet the needs of both shippers and carriers, irrespective of their business size and transportation needs.

TBP’s Outlook on Uber’s Strategy

- Uber has a history of having made billions from its divestitures in China, Russia, and Southeast Asia.

- China was the first tactical exit for Uber where they sold their business unit to Didi for an 18.8% stake, which was later reduced to 15.4% as a result of subsequent fundraising, resulting in a $2 billion increase in value for Uber.

- Uber’s exit from Southeast Asia was a similar play where they sold their business unit to Grab, an online platform that integrates city transportation, for a 30% stake which later reduced to 23%, resulting in a $1 billion increase in value in just one year.

- After a successful exit from China and Southeast Asia, Uber formed a joint venture with Yandex in Russia, grabbing a 38% stake in Yandex at a valuation of $3.68 billion.

- The digital freight brokerage market size was valued at $1.9 billion in 2020 and is projected to reach $18.8 billion by 2028, growing at a rate of 28.8% CAGR.

- To focus on this market, Uber Freight raised $500M in 2020 from Greenbriar Equity Group, valuing the unit at $3.3 billion. This transaction valued Uber Freight at 3.6x its LTM revenue of $917m, ending in September 2020.

- Logistics is undergoing a transformation driven by COVID-19, and we can reasonably anticipate Uber repeating its divestiture strategy to create value by spinning off an Uber Freight IPO.

TBP’s Analysis on Uber’s Acquisitions in the B2C Sector

- In 2020, Uber acquired Postmates for $2.65 billion, an urban logistics platform that connects customers with local couriers that deliver products from various stores and restaurants.

- In 2020, it also acquired RouteMatch Software for $115 million, which provides intelligent transportation systems to public and private transit sectors.

- In 2021, Uber acquired the remaining 47% stake in Delivery Technologies for $1.4 billion, which offers on-demand grocery delivery services.

- These investments represent an investment focus on B2C last-mile delivery which is a fundamentally different business than Uber Freight which is focused on B2B transportation logistics.

Other Notable Players in Digital Freight Brokerage Space

- Along with Uber Freight, companies like Convoy, Transfix, and Loadsmart provide similar services to match carriers and loads based on origin, destination, type of load, price, and timing.

- In 2020, Loadsmart raised $95m at a post-money valuation of $410m, tallying its aggregate amount raised to $151.8m.

- In 2019, Convoy raised $400m at a post-money valuation of $2.75 billion, tallying its aggregate amount raised to $666m.

- In 2017, Transfix raised $42 million tallying its aggregate amount raised to $78.5 million.

- These transactions indicate the established players within the space that have raised funds at a premium valuation.

TBP’s Experience in Transportation Management/Digital Freight Brokerage space

- TBP was the exclusive financial advisor to ProcessWeaver, the leading first-to-final mile multi-carrier transportation management solutions provider, in its acquisition by Elemica.

- TBP doubled down on its earlier co-investment in HwyHaul, a leading digital freight platform for fresh produce, in its recent Series A funding.

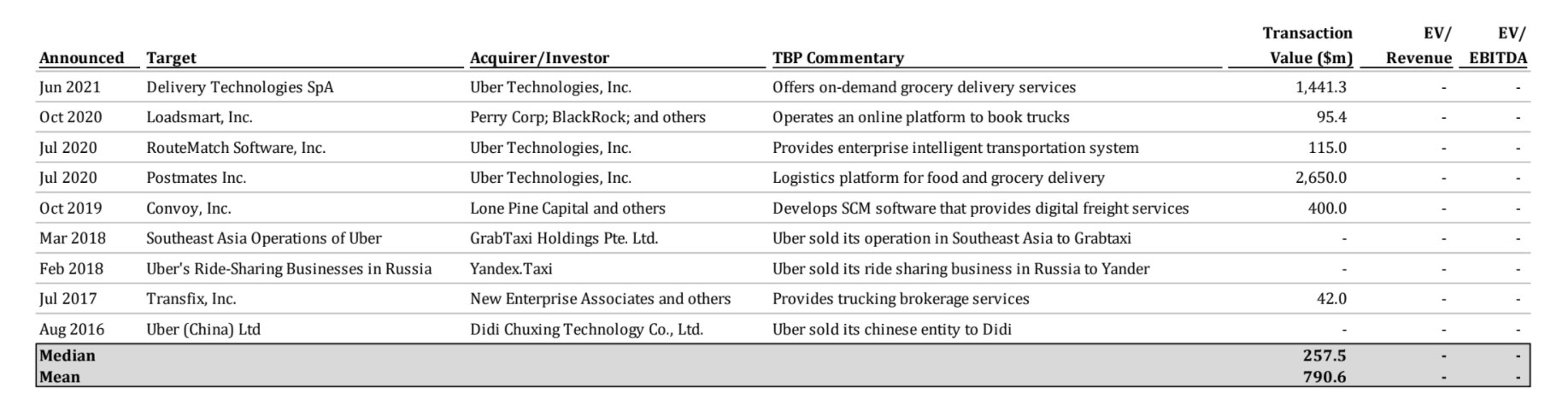

Appendix: Transactions

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.