OSF Digital Announces $43 Million in New Funding

Deal Financials

- Transaction Value: $43.0M

- Enterprise Value / Revenue: Undisclosed

- Enterprise Value/EBITDA: Undisclosed

Transaction Overview

- On May 12, 2021, OSF Digital, an independent Salesforce Platinum consulting partner with global multi-cloud and B2B commerce capabilities, announced it had received a $43m investment led by existing investor Delta-v Capital.

- Existing investor Salesforce Ventures also participated in this round, and personal investments were made by OSF Digital’s Board Chairman David Northington, Board Director Jeff Rich, and Board Advisor Gary DiOrio.

- The capital will be used to support OSF’s planned acquisitions to expand delivery capabilities across various regions.

- This event is followed by a $23m equity investment round led by Delta-v Capital with participation from Salesforce Ventures in May 2019, where True Blue Partners was the exclusive financial advisor to OSF Digital.

OSF Digital’s Growth Through M&A

- In May 2019, OSF Digital received a $23m equity investment from Delta-v Capital and Salesforce Ventures, with the intention of expanding its European presence through M&A.

- OSF Digital quickly utilized the capital to acquire Blueleaf, a UK based eCommerce agency, as part of its strategy to build their UK customer base by establishing a delivery center in the UK.

- Expanding their presence into the Iberian Penninsula, OSF acquired Soul Ecommerce, a Spanish eCommerce agency specialized in online stores. Soul Ecommerce’s specialty in creating, managing, and optimizing online stores aligned with OSF’s goal to launch new direct-to-consumer channels.

- Finally, in December 2019, OSF acquired Successyou, a German eCommerce agency specialized in implementation and customization of B2B commerce platforms. This acquisition strengthened OSF Digital’s B2B solutions, whereas the previous acquisition focused more on direct-to-consumer channels.

- This most recent investment round of $43m will enable OSF to pursue additional acquisitions and expand into untapped regions like the Americas and Asia Pacific.

- In an interview with CRN, OSF Digital CEO Gerard Szatvanyi, stated that his goal is to close four acquisitions this month and up to four additional acquisitions by 2022.

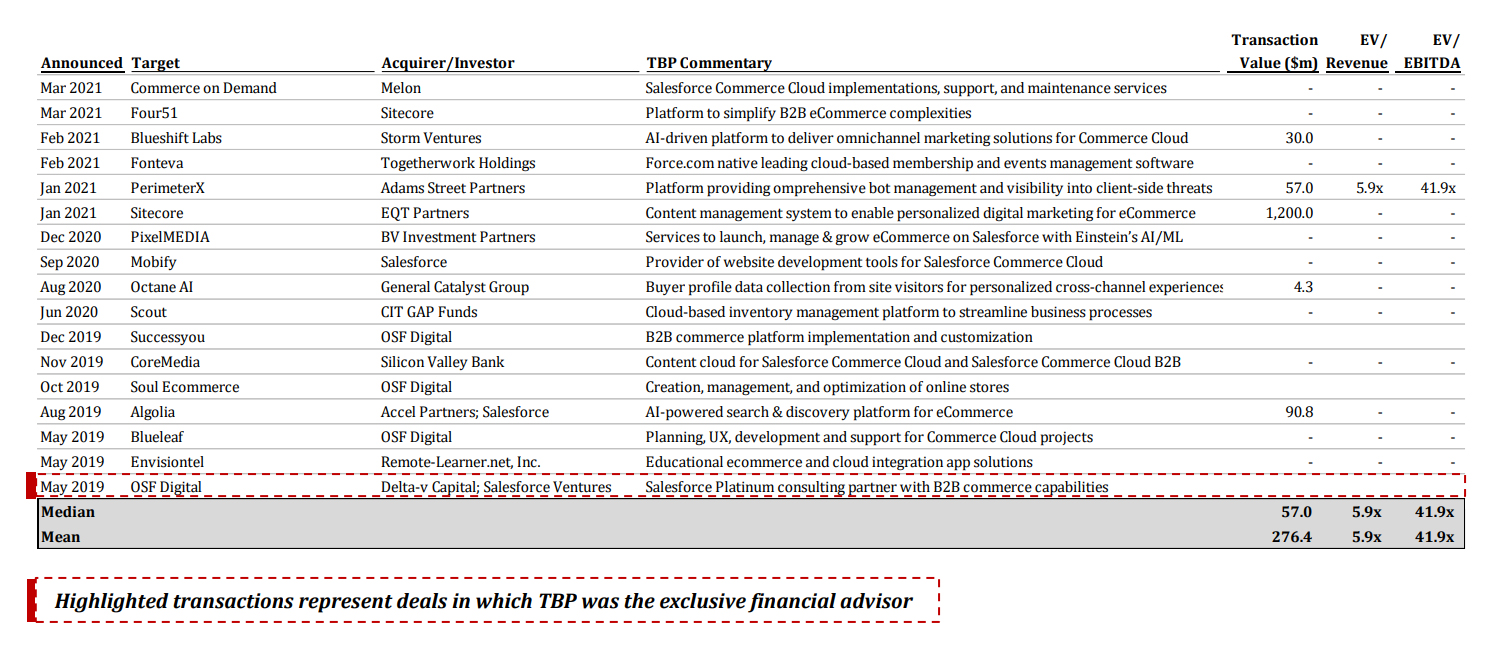

M&A and Private Placement Activity in SFDC Commerce Cloud

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.