Nasdaq to acquire Adenza for $10.5B

Deal Financials

Implied Enterprise Value (EV): $10.7B

EV/Revenue 2023E: ~18.13x

EV/Adjusted EBITDA 2023E2: ~31x

Transaction Overview

- On June 12th, 2023, Nasdaq, Inc. (NasdaqGS:NDAQ), operating as a technology company that serves capital markets and other industries worldwide, announced its agreement to acquire a 100% stake in Adenza Group, Inc., a company that creates and delivers trading, treasury, risk management, and regulatory compliance solutions.

- Adenza includes Calypso Technology (founded in 1997) and AxiomSL (founded in 1991 with reported revenue of $35.2M in Nov 2016), which were combined in 2021 under the ownership of Thoma Bravo.

- The transaction consists of 85.6M of common stock at a par value of $0.01/share of Nasdaqi.e.~14.9% stake and $5.75B in cash, subject to adjustment1. The market cap of Nasdaq is $25.14B.

- Nasdaq plans to raise Senior Bridge Term Loans for up to $5.7B to fund the cash portion and following the transaction, Nasdaq expects leverage of ~4.7x and investment grade ratings of BBB/Baa2 Stable. Nasdaq has planned to reduce leverage to 4.0x in the next 18 months and to ~3.3x in the next 36 months.

- Thoma Bravo’s Managing Partner Holden Spaht is expected to be appointed to the Nasdaq board, expanding the board to 12 members.

- The transaction is expected to close within six to nine months.

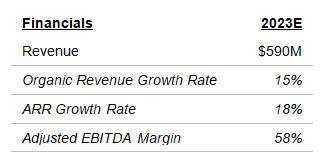

Adenza Financials:

TBP View: Adenza Acquisition, A Positive Sign for Nasdaq

- As currently financial institutions are experiencing and coping with some of the most complex market dynamics in history, this acquisition will bring together two world-class experts soaked in market infrastructure, regulatory, and risk management expertise.

- The addition of the company is expected to enhance Nasdaq’s existing strong financial profile by growing Solutions Businesses Revenue from 71% of total revenue to 77% in 2023E, increasing adjusted EBITDA margin to 57%, and adding ~$300M of annual unlevered pre-tax cash flow.

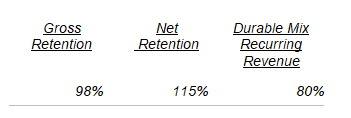

- Adenza has a loyal and growing client base as the company has:

- Adenza, through dual headquarters in New York and London, serves financial institutions including insurance firms, banks, broker-dealers, and similar financial service companies through an end-to-end platform covering everything including data management and reporting, offered either on-premises installation or on the cloud.

- Through this acquisition, Nasdaq will be benefitted as:

- Along with a common geographical footprint, Adenza offers additional relationships across the European banking system to Nasdaq’s already existing strong presence in North America and the Asia Pacific region, aligning the combined entity to meet global demand for outsourced risk management and regulatory solution.

- Introduces a SAM of $10B for Nasdaq, growing 8% per year and increasing Nasdaq’s SAM by ~40% to $34B.

- Growth of Nasdaq’s ARR as a percentage of 2023 pro forma total revenue to 60% from 56% in 2022.

- Nasdaq is expected to achieve $80M in run-rate net expense synergies by the end of year two through functional alignment, product rationalization, location optimization, and consolidation of vendors and real estate.

- Also expected to unlock additional value through cross-sell opportunities, with anticipated run-rate revenue synergies of $50M in the medium term and $100M over the long term.

- Nasdaq’s enterprise-wide return on invested capital will return to over 10% by year five.

- The compliance cost of the banks has increased by more than $50B per year after the implementation of the Dodd-Frank in 2010.

- This acquisition is expected to bring a more complete package of required software and solutions to manage risks and to comply with the regulations in a much simpler yet efficient manner.

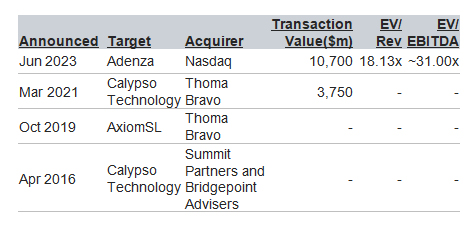

Transaction History: Journey of Calypso (Founded in 1997)

- Adenza originated from two acquisitions of Thoma Bravo. PE acquired AxiomSL in 2019 followed by Calypso Technology the following year and merged the two companies under the Adenza name in late 2021s.

Journey of an Entrepreneur-Kishore Bopardikar

- Calypso Technology, a cloud-enabled provider of cross-asset front-to-back solutions for financial markets, was co-founded by Charles Marston and Kishore Bopardikar in 1997.

- Kishore Bopardikar, a key Executive Network Partner in True Blue Partners Venture Fund 1.

- Under Kishore’s leadership, Calypso has come a long way since 1997 with the company’s major acquisitions by Summit Partners, Thoma Bravo, and now Nasdaq.

- Kishore has also served Infinity Financial Technology Inc., a strong financial trading and risk management company, as a CTO and Director of Software Engineering.

- The Company was founded in 1992 and raised two rounds of funding from Sequoia Capital Operations and later, was bought by SunGard Data Systems Inc. for ~$314M in October 1997.

Notes:

- Based upon the outstanding shares of Nasdaq common stock as of June 9, 2023.

- https://www.cnbc.com/2023/06/12/nasdaq-to-buy-financial-software-firm-adenza-for-10point5-billion.html

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.