Fourkites Secures $100M in Series D Funding

Deal Financials

- Transaction Value: $100M

- Enterprise Value / Revenue: Undisclosed

Transaction Overview

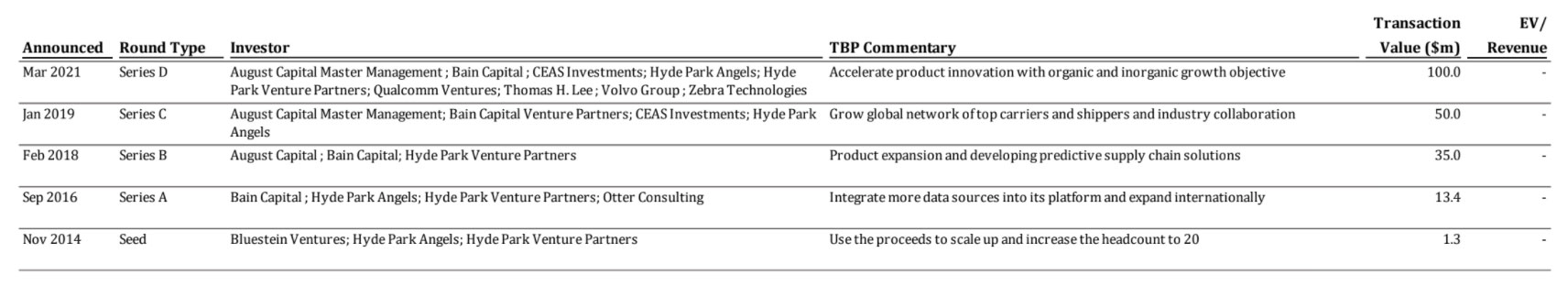

- On March 19, 2021, end to end supply chain visibility provider FourKites raised $100M in series D financing, led by THL, with participation from Qualcomm Ventures, Volvo Group Venture Capital AB, and Zebra Technologies.

- With its new investors, FourKites is now ready to fuel a broader vision for the future of digital supply chain – connecting physical and digital world of warehouses, stores, and transportation with real-time data.

Supply Chain Evolvement Post Pandemic

- Supply chain disruptions caused by COVID in 2020 revealed vulnerabilities in the industry, creating a necessity for real-time visibility solutions amongst companies globally.

- As the entire global transportation visibility market is growing, we have over 100 different vendors in this solution space. The real-time transportation visibility market is thriving with several vendors growing at 100% and even 200% year over year.

- The global supply chain management market is projected to reach $37.41 billion by 2027, growing at a CAGR of 11.2% from 2020 to 2027. Various investment firms and companies have started investing in companies that have enhanced capabilities in the digital supply chain industry.

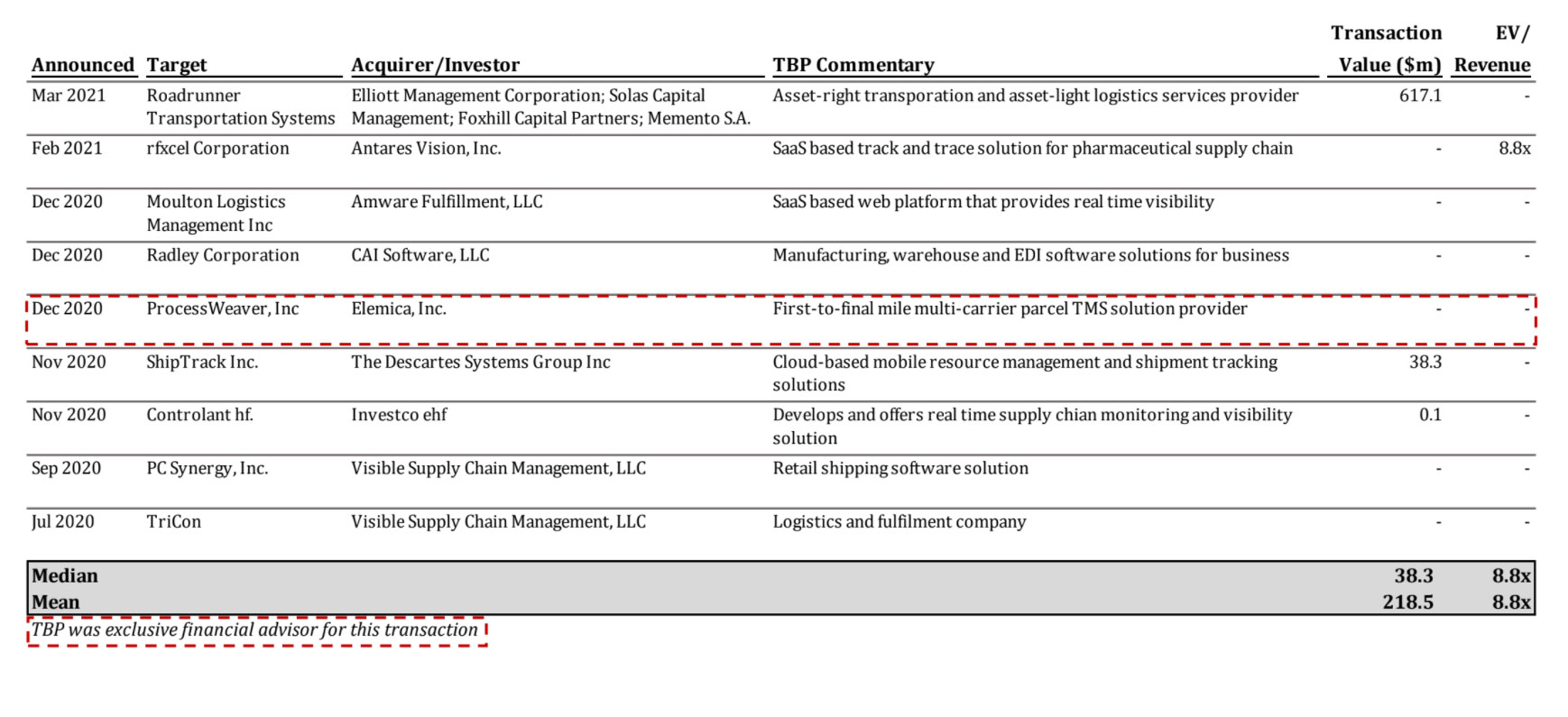

M&A and Investment Activity Remains Robust in Supply Chain

- In Sep 2020, Visible Supply Chain Management acquired PC Synergy, a retail shipping and software solutions company. Prior to this acquisition, they acquired Tricon and enhanced their logistics and fulfilment capability.

- In Nov 2020, Descartes acquired ShipTrack for $38.3M, adding cloud-based shipment tracking solutions to their logistics platform.

- In Dec 2020, Elemica acquired ProcessWeaver, adding TMS solutions to its network. TBP was exclusive financial advisor in this transaction and secured a strategic valuation for ProcessWeaver.

- Most recently in Mar 2021, Roadrunner Transportation raised $50 million from various institutional investors, indicating their interest in acquiring various supply chain management solutions.

- Overall, the M&A and investment landscape remain strong in the Supply Chain Industry as companies continue to look to expand through inorganic growth and investors look to invest their capital.

Recent Notable Transactions in Supply Chain

FourKites Investment Round

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.