Wisetech Global Acquires Trinium Technologies

Deal Financials

| Implied Enterprise Value (EV)($m): | 49.9 |

| EV / LTM Revenue: | 6.0x |

| EV / LTM EBITDA: | 19.1x |

Transaction Overview

- On August 16, 2018, Australian logistics software provider Wisetech Global announced its acquisition of Trinium Technologies, a North American provider of intermodal trucking transportation management systems (TMS).

- Notably, Wisetech is valued at 26.2x LTM Revenue. This is significantly higher than its 15.1x multiple in September 2017, shown in our Spotlight on its acquisitions of Cargoguide and CargoSphere.

Developing a Global Logistics Platform

- Wisetech raised $126 million by going public on the ASX in April 2016 to secure funding for inorganic growth. In May 2018, the company raised another $100 million in a PIPE transaction to further accelerate its M&A strategy.

- Since its IPO, Wisetech has acquired a total of 25 companies, including eleven in 2018 alone.

- Wisetech has been using M&A to expand its geographic footholds worldwide. Of its eleven acquisitions in 2018, four were headquartered in North America, four in Europe, two in Latin America, and one in the Middle East.

- Wisetech has paid an average multiple of 5.9x LTM Revenue for its three most recent acquisitions, a significant increase over the average 4.0x LTM Revenue multiple that it paid in 2017. This is consistent with the increase in valuation multiples seen in the overall market during this time frame.

Ecommerce Driving Global Logistics

- In a recent Investor Presentation, Wisetech cited ecommerce as one of the largest external drivers of its growth. As retailers and brands continue to migrate to an omni-channel business model in response to rising customer expectations, the ecommerce market is expected to grow to over $4 trillion in 2021, according to Statista.

- Descartes Systems Group, a Canadian supply chain software company, also cited omni-channel trends and consolidative M&A as growth drivers in its FY2018 Investor Presentation. As another acquisitive player in the space, Descartes has consistently made three or more acquisitions per year since 2012, including its August 2017 acquisition of MacroPoint, a supply chain visibility solution provider, for $107 million at an 8.5x LTM Revenue multiple.

- The space has also seen significant investment activity; two providers of supply chain visibility solutions, KeepTruckin and Samsara Networks, each raised $50 million from notable investors in March. KeepTruckin’s investors included GV and Index Ventures, and Samsara Networks’ included Andreessen Horowitz and General Catalyst.

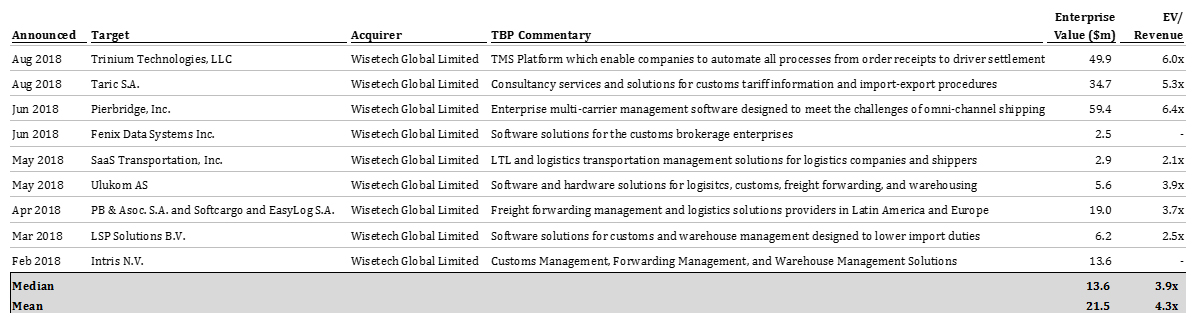

Recent WiseTech Global Transactions

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.