Atos Acquires Syntel for $3.6 Billion

Deal Financials

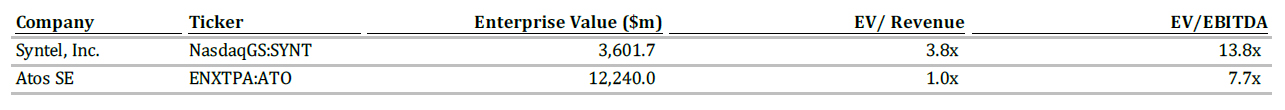

| Total Implied Enterprise Value: | 3,601.7 |

| Premium Over One Day Prior: | 4.8% |

| Premium Over One Month Prior: | 28.1% |

| Implied EV/LTM Revenue: | 3.8x |

| Implied EV/LTM EBITDA: | 13.8x |

Transaction Overview

- On July 22, 2018, French IT services firm Atos SE (ENXTPA:ATO) announced its acquisition of Syntel, Inc.

(NasdaqGS:SYNT), a Michigan-based IT services provider, in an all-cash deal valued at $3.6 billion.

A Move to Enhance Atos’ Growth and Profitability Profile

- In the past three years, Atos has been growing at a decreasing pace, slowing from double-digit to single-digit growth,

while experiencing thin EBITDA margins consistently below 15%. - Despite Syntel’s flat growth in the recent years, its EBITDA margins have stabilized at north of 25%, making it a strong

target for M&A as well as means for Atos to enhance its profitability. - In additional to improving combined EBITDA margins, this deal will bolster Atos’ capabilities in the banking, finance,

and insurance verticals while expanding its footprint in North America. - In a similar France-US transaction, Atos’ French competitor Capgemini acquired iGATE for $3.9 billion in an all-cash

deal in 2015 to boost the company’s exposure in the fast-growing US market.

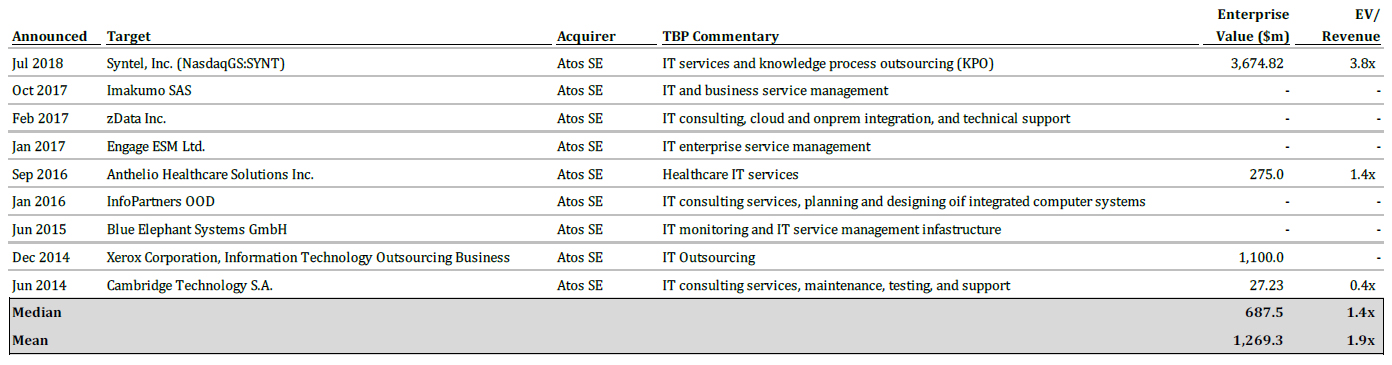

Notable Atos Transaction

Syntel’s Prolonged Journey to a Multi-billion Dollar Exit

- In 1980, Syntel was founded by the husband-wife team of Bharat Desai and Neerja Sethi from their apartment with a

mere $2,000 investment. Four years prior to starting Syntel, Bharat came to the US as an IT consultant after he

received a bachelor’s degree in electrical engineering from IIT Bombay. - In its first year, the company generated just $30,000 in annual revenue before Bharat graduated from the University

of Michigan Ross School of Business. - Since then, the company relied mostly on organic growth and grew to $944 million in LTM revenue as of today,

representing a 31% revenue CAGR over 38 years. Bharat and Neerja, who together hold a 57% stake in the company,

will receive $2 billion on this deal, resulting in a phenomenal annual IRR of 43% over 38 years on their initial $2,000

investment. Throughout the company’s lifecycle, Syntel only made three acquisitions, the latest of which was in 1999. - Nevertheless, the journey to exit was not always smooth for Syntel. In mid-2015, Bain-backed outsourcing firm

Genpact considered a possible acquisition of Syntel in a deal that never came to fruition. As a consolation prize, Syntel

issued a nearly $1.5 billion special dividend and took on a modest amount of debt.

True Blue Partners Perspective

- Atos is trading at a revenue and EBITDA multiple that is lower than the price it paid to acquire Syntel. Therefore, not

considering potential revenue and cost synergies, Atos’ transaction is dilutive to Atos’ shareholders from a purely

financial perspective, on both a revenue and an EBITDA valuation basis. Atos’ shares were down 6.7% on news of the

transaction.

- This further supports our broader findings reported elsewhere that larger and unique assets are able to command a

significant valuation premium. - The market for IT services transactions continues to remain strong, and large, complex deals that may have been on

hold for the past few years are now being completed. - This also signifies that leaders in the market continue to believe in the continued growth in the global IT services

market.

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.