Synnex’s Concentrix Division Acquires Convergys

Deal Financials

| Total Implied Enterprise Value ($m): | 2,543.0 |

| Implied EV/LTM Revenue: | 0.9x |

| Implied EV/LTM EBITDA: | 7.4x |

| Premium Over One Day Prior: | 7.7% |

| Premium Over One Month Prior: | 9.6% |

Transaction Overview

- On June 28, 2018, Synnex’s Concentrix division announced its acquisition of call center giant Convergys in a cash/stock deal valued at $2.7 billion.

- This transaction strengthens Concentrix’s leadership position in the customer experience outsourcing industry and creates a premier global customer engagement services company.

Concentrix’s Long History of M&A

- After Concentrix’s acquisition of IBM’s Customer Care business in 2013, it has become one of the industry leaders in Business Process Outsourcing and Customer Care.

- It has since cemented its status as a leader in the space through industry consolidation and acquisitions of call centers that span a variety of verticals. Its acquisition of Minacs in 2016 expanded its offerings in the automotive sector, and its acquisition of The Global Email Company in 2011 expanded the company’s geographical footprint, multilingual capabilities, and social media-related offerings.

- The acquisition of Convergys underscores Concentrix’s strategy to consolidate further by strengthening their verticals in technology, banking and financial services, and healthcare.

Same Industry, Same Playbook

- Similarly to Concentrix, Convergys has pursued a roll-up strategy. In early 2014, it acquired a premier provider of customer management services, Steam Global Services, for $820m, creating the one of the largest customer management services providers in the world.

- A year prior to that, Convergys bought New Zealand-based Datacom’s contact center operations in Southeast Asia for $21m to expand its global footprint and multilingual BPO services offerings.

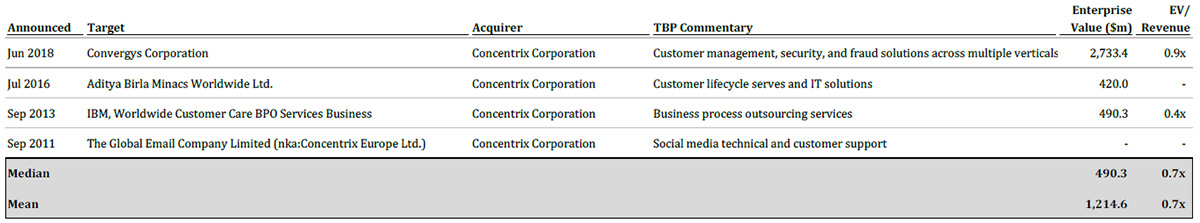

Relevant Concentrix Transactions

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.