Siris Capital Offers to Acquire Web.com

Deal Financials

| Total Transaction Value ($m): | 1,874.0 |

| Premium Over One Day Prior: | 7.8% |

| Premium Over One Month Prior: | 35.5% |

| Total Implied Enterprise Value: | 1,864.3 |

| Implied EV/LTM Revenue: | 2.5x |

| Implied EV/LTM EBITDA: | 12.7x |

Transaction Overview

- On June 22, 2018, private equity firm Siris Capital announced its all-cash acquisition of Web.com, a provider of website hosting and marketing services to small businesses.

- Under the terms of the agreement, Web.com may solicit alternative proposals from third parties during a “go-shop” period until August 5, 2018, while Siris holds a customary right to match a superior proposal.

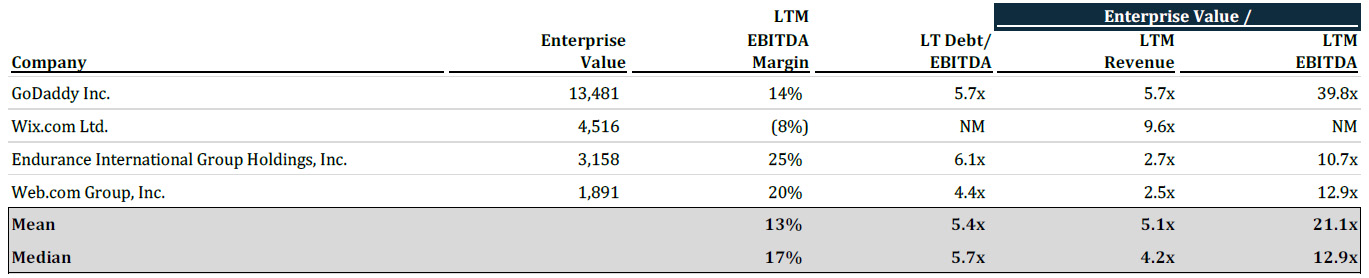

- Two of Web.com’s largest direct competitors are GoDaddy and Endurance. GoDaddy is the twice the size of Web.com in Enterprise Value, and is currently valued at 5.7x LTM Revenue and 39.8x LTM EBITDA, whereas Endurance is similar in size to Web.com, and is valued at 2.7x LTM Revenue and 10.7x LTM EBITDA. However, Web.com has the lowest Longterm Debt/EBITDA ratio among the three, making it a more appropriate target for a leveraged buyout.

Growth Through Consolidation

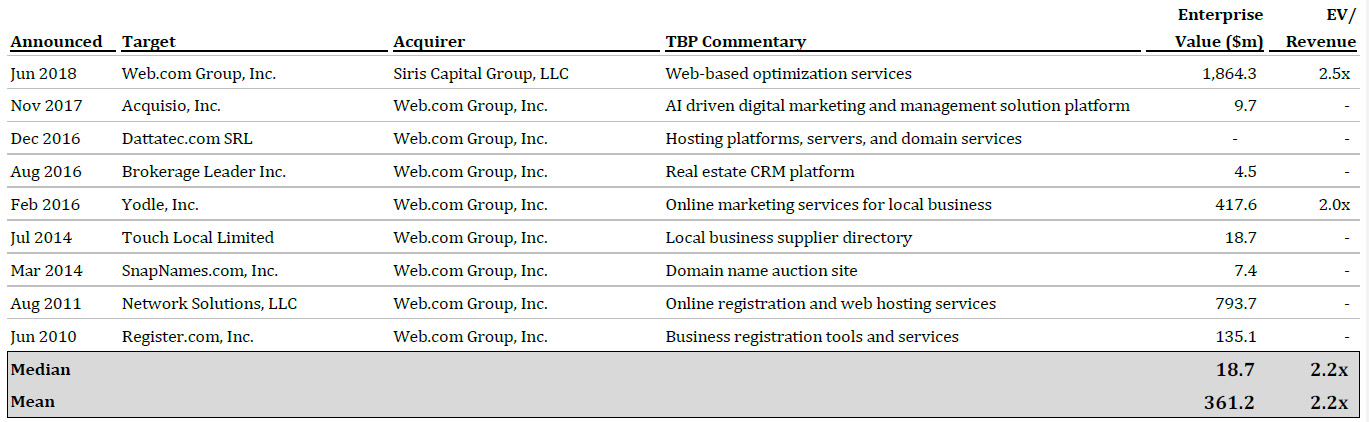

- Web.com, currently traded on the NASDAQ with the ticker WEB, has a history of strengthening its business position through M&A.

- The market for web services for SMBs remains fiercely competitive, as low barriers to entry and downward pressure on prices have eaten up the profitability of many companies in the space.

- Many companies in this space such as Squarespace and Wix.com seek to gain market share from the established players such as GoDaddy.

- In early 2016, Web.com expanded into new areas, buying local marketing services provider Yodle for $428.2m, followed by three smaller transactions in adjacent spaces.

- Notably, five years prior to that transaction, Web.com also acquired Network Solutions, a provider of domain registrar and web hosting services, to gain scale and compete against GoDaddy.

Recent Web.com Transactions

Same Industry, Different Stories

- While Web.com, GoDaddy, and Endurance have been competing among themselves, overall competition in the space has intensified as two other forces have entered. On one side is Google, and on the other, a number of newcomers such as Wix.com and Squarespace that provide hosting services to small business through their networks.

- As a result, the three incumbents have been consolidating the market through M&A.

- In late 2015, Endurance International acquired Constant Contact for $1.1 billion with borrowed money, which represented a significant amount of debt for Endurance with its Enterprise Value of $2.6 billion at the time.

- Less than a year afterwards, GoDaddy acquired Host Europe Group, one of the largest privately-owned web services providers in Europe, to accelerate its expansion in the region.

- Notably, both GoDaddy and Endurance have been acquired by PE firms at some point before going public.

Web.com Public Comps

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.