IBM Acquires 7Summits

Deal Financials

- Enterprise Value / Revenue: Undisclosed

Transaction Overview

- On January 11th, 2021, NYSE:IBM announced its acquisition of 7Summits, an independent Salesforce Platinum Consulting Partner specialized in delivering transformative digital experiences.

- Notably, 7Summits is part of IBM’s broader investment strategy focused on Salesforce ecosystem-focused services providers.

Growth Through Acquisition– the Salesforce Ecosystem Remains Robust

- IBM launched its Salesforce consulting practice in 2016 by acquiring Bluewolf for $200m. 5 years ahead of the acquisition, Bluewolf received capital from Riordan Lewis & Haden with participation from Salesforce Ventures.

- The acquisition of 7Summits is the first time since then that IBM has inorganically built on its existing strategic partnership with Salesforce. Similar to Bluewolf, 7Summits raised rounds of capital from Salesforce Ventures, Sverica Capital Management, and Holton Investments prior to sale. All three investors participated in the most recent round in 2017 as repeat investors.

- Infosys’s acquisition of Fluido in 2018 and subsequently Simplus in 2019 are examples of this concept. Fluido raised 2 rounds of funding and Simplus raised 6 rounds of funding prior to sale, both with participation from Salesforce Ventures. Notably, Simplus made 7 acquisitions prior to its sale. True Blue Partners was a co-investor in Simplus.

- Similarly, 4C Consulting raised two rounds of capital from Trocadero Capital Partners and Salesforce Ventures, and acquired 3C Consult and CloudSocius prior to its sale to Wipro in August 2020.

- Larger companies have been meeting customer demand for Salesforce capabilities through acquisition.

- Private Equity and Venture Capital companies have been active in making private placements fueled by the prospect of exit opportunities through M&A, a cycle demonstrated in the above examples.

- Recent private placements of note include Salesforce Ventures investments in Apisero, Zennify, and also in Coastal Cloud, together with Sverica Capital Management.

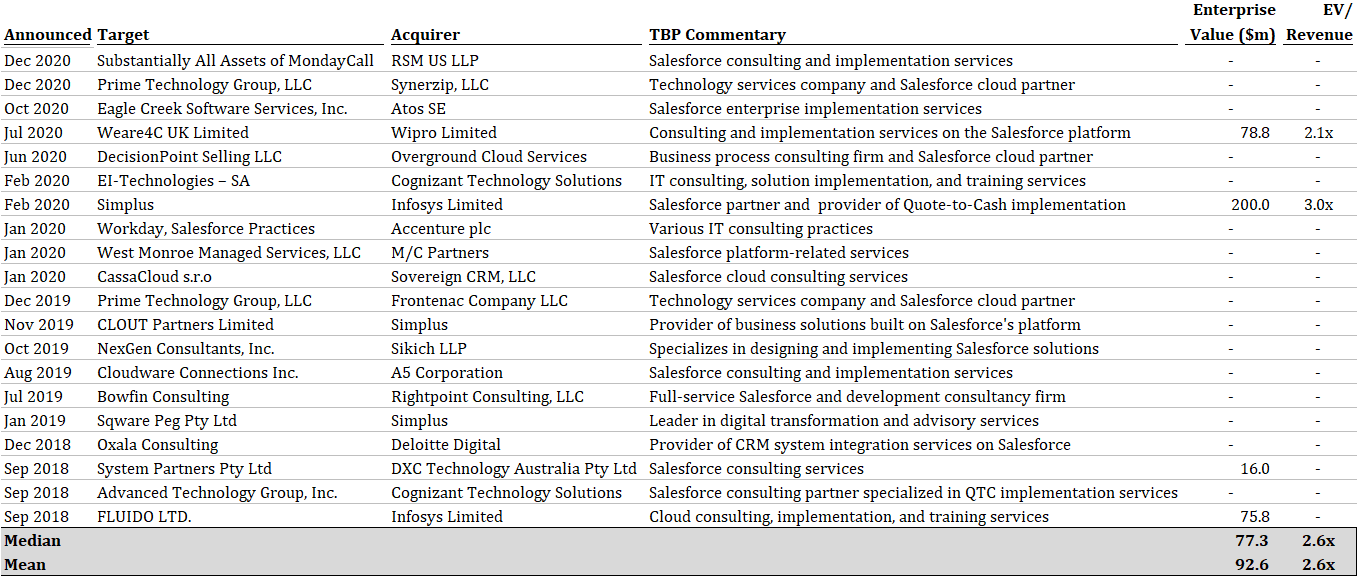

Salesforce Consulting Partners M&A Transactions

Salesforce Consulting Partners Private Placement

About True Blue Partners

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info@truebluepartners.com.

TBP was NOT an advisor to this transaction.