Marlin Equity Acquires Tangoe (OTCPK:TNGO)

Sunil Grover, Managing Partner

sgrover@truebluepartners.com

(669) 900-4031

Transaction Overview

-

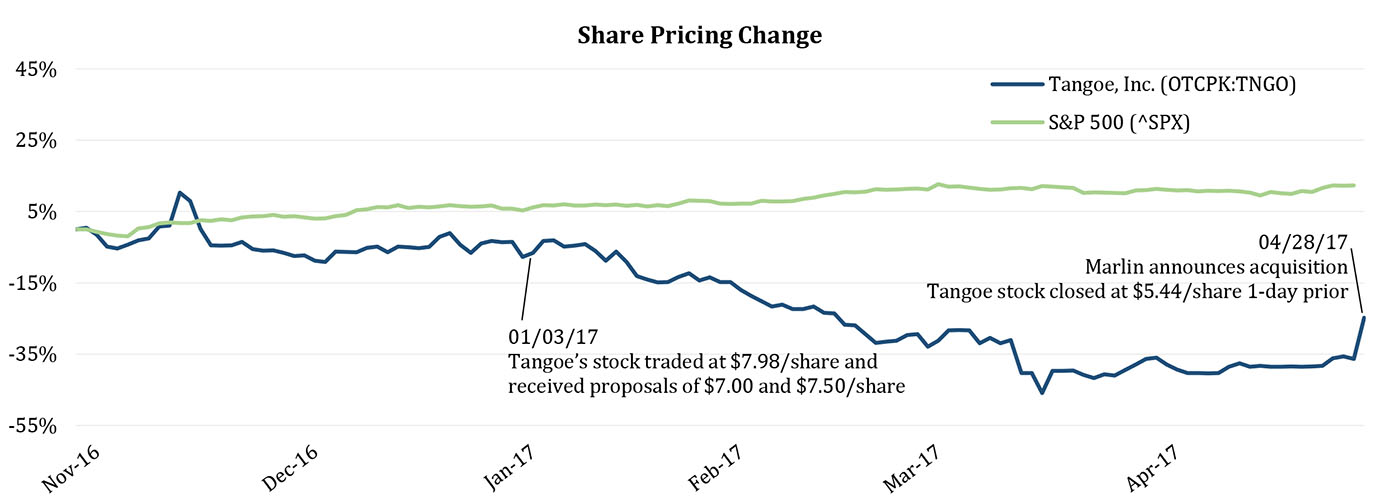

- On April 28, 2017, Marlin Equity Partners announced that it has entered into a definitive agreement to acquire all outstanding shares of Tangoe, Inc. (OTCPK:TNGO) for $6.50/share in cash.

- Marlin intends to combine Tangoe with its existing portfolio company Asentinel, which was acquired in 2015.

- Tangoe provides software and strategic consulting services with offerings in telecom expense management (TEM), mobile device management (MDM), Lifecycle management (LCM), and mobility-as-a-service (MaaS).

Earlier Proposals to Acquire Tangoe by Vector, Clearlake and Marlin

- On Jan 03, 2017 Tangoe had received acquisition proposals from Clearlake Capital and Vector Capital for $7.00/share (-12.3% premium), and Marlin Equity for $7.50/share (-6.0% premium).

- The final acquisition price is 13% lower than the original proposal from Marlin just three months prior.

- Marlin intends to combine Tangoe with its existing portfolio company Asentinel, which was acquired in 2015.

- See our previously spotlight and analysis on the acquisition proposals at https://truebluepartners.com/clearlake-vector-tangoe-inc-spotlight/. Our analysis had showed that the highly consolidated market would present headwinds for the few remaining independent TEM/MDM companies on the market, ultimately driving valuations down.

True Blue Partners is a M&A advisory firm that serves lower mid-market enterprise software companies, and provides its clients with over 20 years and of investment banking and technology business operations experience. It’s founders have extensive experience on all sides of a deal as a financial advisor, private investor, and founder operator, which allows for a unique perspective into the challenges and needs that companies face within the lower mid-market.