Sage(LSE:SGE) Acquires Intacct

Sunil Grover, Managing Partner

sgrover@truebluepartners.com

(669) 900-4031

Deal Financials

Total consideration: $850m ($807m cash, $43m stock options)

Intacct LTM revenues in 2016 and 2017 of $67m and $88m respectively

Transaction Overview

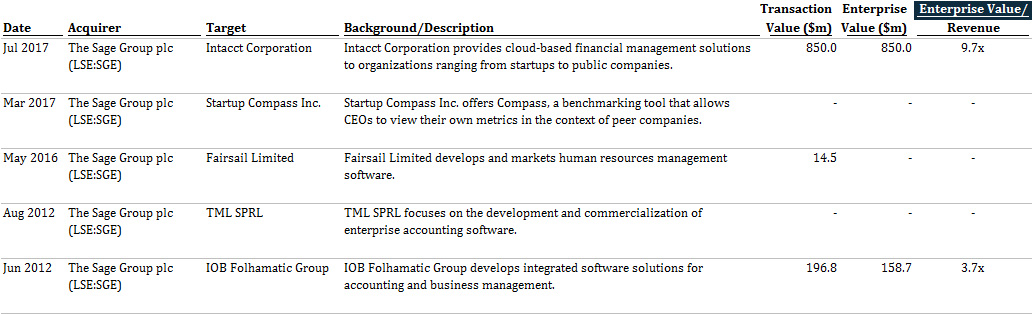

- On July 25th, 2017, the Sage Group, the world’s third-largest ERP software provider, announced their acquisition of Intacct Corp for a total consideration of $850 million in cash.

- Sage serves 6.1 million customers worldwide through their Accounting, Payroll and HCM, and Payments software.

- Intacct serves small to mid-sized customers with industry-leading, cloud-based accounting software, competing directly with Intuit’s Quickbooks.

- Sage now boasts the “the first and last cloud financial management solution a customer will ever need from start-up to enterprise” through this bolt-on acquisition.

Markets are Willing to Pay a Premium for Top Performing Assets

- Intacct sports a highly impressive business profile that helped to create a premium valuation.

- Cloud SaaS revenues and offerings

- Strong 33% revenue growth rate on a trajectory to reaching $100m

- Buyers and investors tend to view the $100m revenue mark, coupled with a strong growth rate, as a sign of market dominance; at this point valuation multiples inflate significantly.

Sage is Expanding its Suite of SMB Offerings

- Sage’s willingness to purchase Intacct at a 9.7x revenue multiple indicates the intense pressure the company faces to compete with cloud-based rivals for US customers.

- Recent acquisitions in the HR and Accounting segments allow Sage to provide a complete set of enterprise solutions, as opposed to single segment solutions currently provided by most mid-market providers.

True Blue Partners is a M&A advisory firm that serves lower mid-market enterprise software and service companies. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com