Salesforce.com Acquires MuleSoft

Deal Financials

Enterprise Value ($m):

6,602.6

EV / LTM Revenue:

22.3x

Transaction Overview

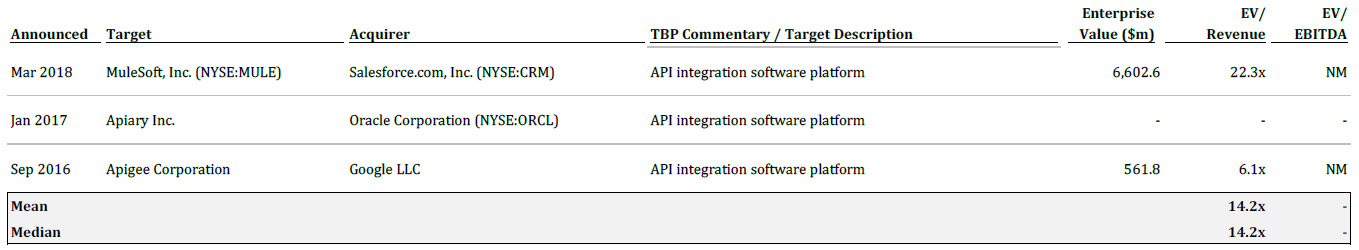

- On March 20, 2018, leading CRM software-as-a-service provider Salesforce.com announced its acquisition of MuleSoft, a provider of an application integration software platform.

- MuleSoft is Salesforce’s largest acquisition in its company history, with an enterprise value of $6.6 billion and a 36% premium over MuleSoft’s closing share price on March 19. Its second largest was Demandware, which it acquired for $3 billion in 2016.

API Software in a Poly-Cloud Environment

- API software is becoming increasingly important in a poly-cloud environment, where customers are using multiple software applications, each from a different provider.

- Salesforce’s acquisition of MuleSoft has the potential to strengthen its ecosystem by increasing the capabilities of its Force.com PaaS offering.

- Notable similar transactions include Oracle’s acquisition of Apiary in early 2017 and Google’s acquisition of Apigee in late 2016.

Ecosystem Strategies in Action

- Aside from Salesforce, MuleSoft received equity investments from several other high-profile strategics whose respective ecosystems benefited from its integration platform: ServiceNow, SAP, and Cisco.

- These large-cap software providers, and many others, have begun building their own ecosystems via investments, following Salesforce’s strategy.

- In addition to gaining access to capital and strategic advice, companies that receive these investments gain the opportunity to be acquired by their strategic investors. Steelbrick and CloudCraze were two other examples of companies that first received investments from Salesforce Ventures, then got acquired by Salesforce.

- Read more about Salesforce’s ecosystem-focused strategy in our recent report, Investments and M&A Trends in the Salesforce Ecosystem.

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com