WiseTech Global Acquires SmartFreight

Deal Financials

| Implied Enterprise Value (EV) ($m USD): | 39.3 |

| EV / LTM Revenue: | 7.0x |

| EV / LTM EBITDA: | 55.0x |

Transaction Overview

- On August 16, 2018, Australian logistics software provider WiseTech Global Limited (ASX:WTC) announced its acquisition of IFS Global Holding Pty Ltd (SmartFreight), an Australian provider of multi-carrier less-than-truckload (LTL) shipping and parcel shipping solutions.

- The purchase comprises of a $14.3m (USD) upfront payment and an additional $25.0m (USD) based on business and product integration, customer transition, and 2020 revenue performance.

Developing a Global Logistics Platform

- WiseTech raised $126.0 million by going public on the ASX in April 2016 to secure funding for inorganic growth. In May 2018, the company raised another $100.0 million in a PIPE transaction to further accelerate its M&A strategy.

- Since its June 2015, WiseTech has acquired a total of 28 acquisitions, including eleven in 2018 alone.

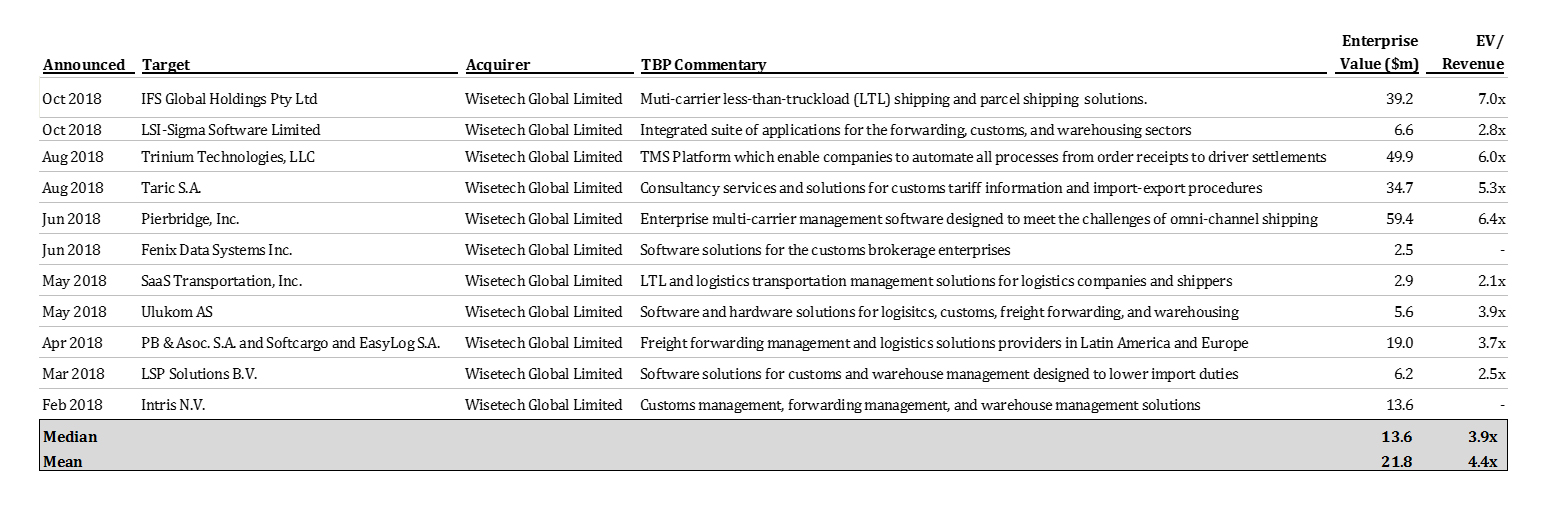

- Notably, the target company’s size and the buyer’s expansion strategy have been significantly influential factors when WiseTech values a company. Of the company’s eleven acquisitions in 2018, the larger target companies predominantly offered geographic expansion or were freight forwarding software providers. The valuation of these companies ranged from 5.3x to 7.0x Revenue, whereas companies below $20m EV were valued below 4.0x.

- WiseTech has paid an average multiple of 5.5x LTM Revenue for its five most recent acquisitions, a significant increase over the average 4.0x LTM Revenue multiple that it paid in 2017. This is consistent with the increase in valuation multiples seen in the overall market during this time frame.

E-commerce Driving Global Logistics

- In a recent Investor Presentation, WiseTech cited e-commerce as one of the largest external drivers of its growth. As retailers and brands continue to migrate to an omni-channel business model in response to rising customer expectations, the ecommerce market is expected to grow to over $4 trillion in 2021, according to Statista.

Recent WiseTech Global Transactions

About True Blue Partners, LLC

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com.