Oracle Acquires Aconex for AU$1.6b

Sunil Grover, Managing Partner

sgrover@truebluepartners.com

(669) 900-4031

Deal Financials

Transaction Size: AU$1,641.2m

Enterprise Value: AU$1,609.9m

EV/LTM Revenue: 10.0x

Transaction Overview

- On Nov 27, 2017 Vantive Australia Pty Ltd, a subsidiary of Oracle, entered into a definitive agreement to acquire Aconex Ltd (ASX:ACX) for approximately AU$1.6b; Aconex stockholders will receive AU$7.8/share of Aconex common stock; this represents a 47.7% premium on the share price 1 day prior to the announcement

- Headquartered in Melbourne Australia, Aconex provides cloud-based project management and collaboration software for the construction industry; as of August 2017 LTM revenue was AU$162.2m and EBITDA was AU$3.7m

Oracle Continues its Cloud Push

- Oracle made 9 acquisitions in 2016, but only 4 this year; 3 of these acquisitions have been into developing back-end cloud technologies (Apiary, Wrecker, Moat)

- In 2016, Oracle had acquired Textura, a cloud-based contract and payment management platform for the construction industry, for $663m and combined it with Oracle Primavera to form the Oracle Construction and Engineering Unit

- The Aconex acquisition comes right after Oracle’s Q2 earnings release, where they announced quarterly cloud revenue of $1.5b ($1.1b from SaaS), a 44% YoY increase; in contrast on-premise new license revenue remained stagnant and hardware revenue dropped 7%

Cloud Shift Creates Waves for the Lower Mid-Market

- As repeated in our earlier spotlights, Oracle’s shift to the cloud has started a wave of consolidation over Oracle system integrators and resellers in the lower mid-market; there have been over 11 acquisitions of Oracle SIs in just the LTM

- SIs differentiating themselves by creating software-enabled service offerings, and lower level providers acquiring up the technology stack to offer end-to-end managed service offerings

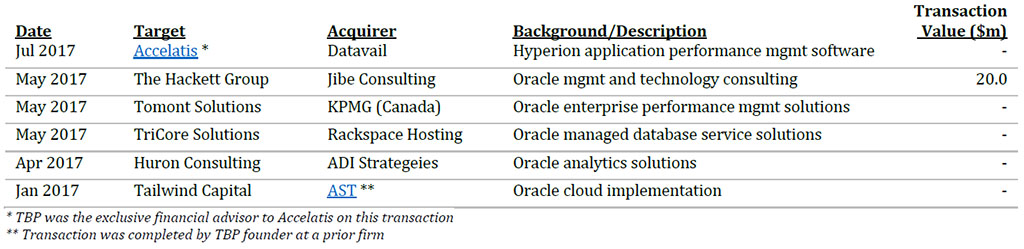

Notable Oracle SI Transactions in 2017

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com