Valuations, Investments and M&A trends in Salesforce.com ecosystem

Sunil Grover, Managing Partner

sgrover@truebluepartners.com

(669) 900-4031

On multiple occasions these CEOs told us that it was the most authoritative review of M&A trends in the Salesforce eco-system they had seen so far.

The updated market report (available below for download through SlideShare) incorporates our findings from these meetings and numerous other conversations and observations from walking the exhibit floor.

To view article slides presentation on SlideShare.

Highlights of what’s included …..

- Case studies on Veeva IPO, Apttus, SteelBrick, Servicemax

- Profile and identity of the Company replicating Veeva strategy and getting traction

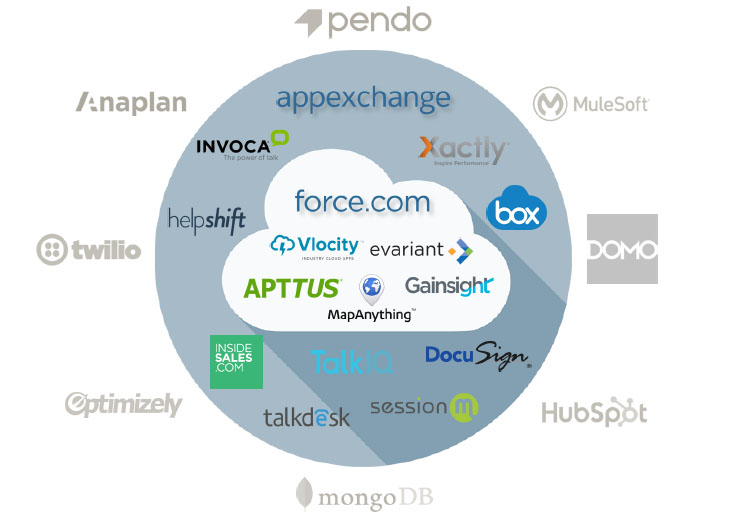

What are “Cloud-Pools”….

- ..and how established companies are using it to diversify out of Force.com

Salesforce.com venture investments that we should probably rename..

“How to be the first to build a $10 Billion ARR SaaS company”

(…psst..target this list if you are raising an Enterprise SaaS VC round)

Key opportunities for Salesforce.com focused System Integrators/Professional Services

- Case studies on CloudCraze, Apprio

- Profile and identity of the Company replicating CloudCraze and Apprio strategy today.

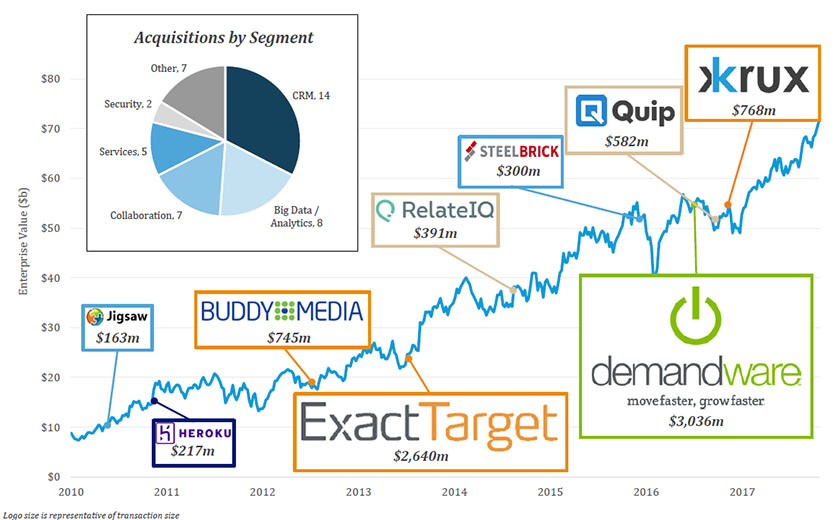

Companies Salesforce.com has acquired

- 20+ acquisitions in 24 months window

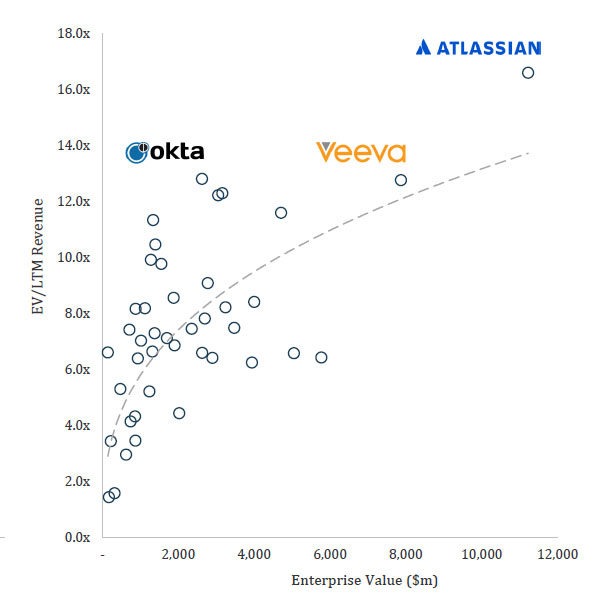

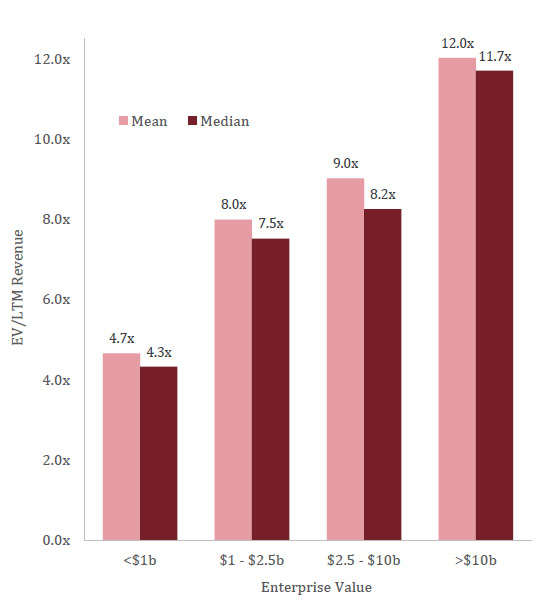

The most compelling review of factors that drive valuations in enterprise SaaS including

- Company size

- Revenue growth rate

- Change in revenue growth rate

- Gross Margins

- Net Margins

- Target Markets

- Leadership premiums in target markets

If you find the report helpful, feel free to like or re-share this post, or reuse it with appropriate citation to TBP.

If we can be helpful, I would be glad to have a conversation.

True Blue Partners is a boutique M&A advisory firm that serves lower mid-market enterprise software, service and solutions companies. It brings the rigorous strategic and financial perspective of bulge bracket firms with a company building approach and a steadfast partnership that only an independent boutique firm can deliver. For more information please visit www.truebluepartners.com or email us at info @ truebluepartners . com